- myFICO® Forums

- Bouncing Back from Credit Problems

- Rebuilding Your Credit

- Amex Apollo Reinstatement process

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Amex Apollo Reinstatement process

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- « Previous

- Next »

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Amex Apollo Reinstatement process

Im glad Amex is continuing with the Apollo Program.

For those of you on the Apollo Program, how does your reinstated card account report on the CRA?

Barclays: Arrival+ WEMC

Capital One: Savor WEMC, Venture X Visa Infinite

Chase: Freedom U Visa Signature, CSR Visa Infinite

Citibank: AAdvantage Platinum WEMC

Elan/US Bank: Fidelity Visa Signature

Credit Union: Cash Back Visa Signature

FICO 08: Score decrease between 26-41 points after auto payoff (11.01.21) FICO as of 5.23, EX: 812 / EQ: 825 / TU: 815

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Amex Apollo Reinstatement process

Thanks for this thread. I also fell on hard times and thought all was lost with Amex! I paid off two of my accounts previously and defaulted on an Amex Optima card over a year ago. It shows canceled when I log in. I called the Apollo number on this thread and was told they no longer serviced the account, but I they can see about returning it to Amex. They told me to Expect a call in about seven days. So now I wait. I'm hoping I can get back in Amex! I will keep the thread posted. This certainly helped me with so much already.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Amex Apollo Reinstatement process

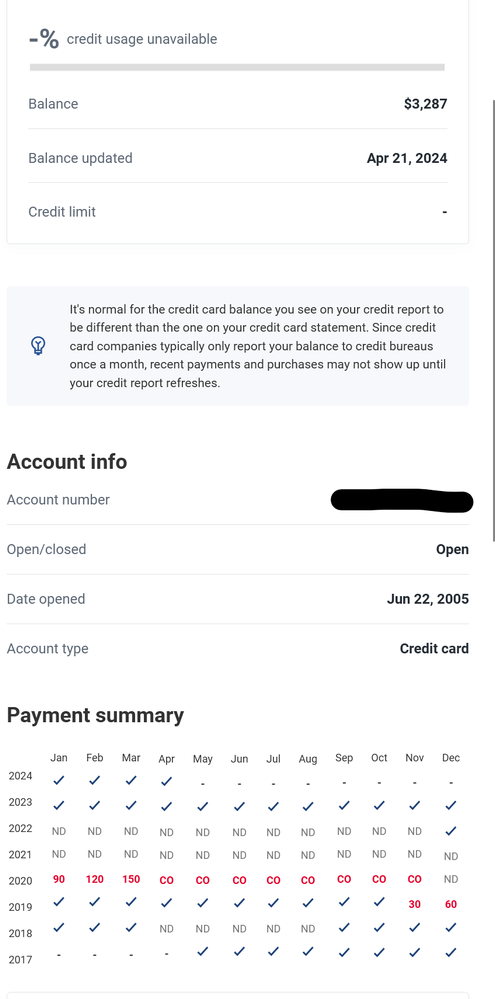

It reports like a regular Amex NPSL (I have platinum charge) under the existing account that was reinstated (not a new account). The months that I didn't pay them show the appropriate statuses (from 30, 60 ,90, 120, 150 days and finally to CO status). Then the checkmarks pick back up for paid as agreed once it got reinstated under Apollo.

Screenshot of my Experian showing the original open date of 2005 so it's the same account being updated with positive activity once it was reinstated. It also shows that there is no limit / usage % (even though I have a hard limit!).

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Amex Apollo Reinstatement process

@razewick wrote:Hey cardslayer,

Thanks for all the great information.

I am going through this process currently with a canceled Platinum Amex due to charge-off and it has gone EXACTLY as you mentioned.

I wanted to clear my debt with Amex so called the debt collector, Radius Global Solutions and was surprised when they offered me a pathway to regain cardmembership with the same Platinum Amex.

I paid the balance 13 days ago, then I got the call today where they confirmed identification and income etc. They told me it was approved and I would see the card within 7-10 days! So pumped! I was doubtful it would happen until the bitter end!

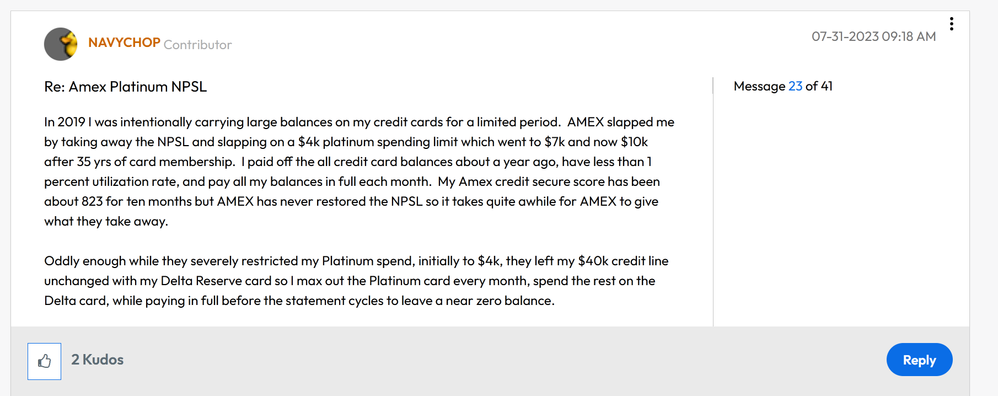

I also have been given the $4700 hard limit, I wanted to check-in with you to see if that limit has now been lifted since its more than 12 months later? Is it back to NPSL? Any updates?

Cheers

Congrats on getting back in! No, I still have the hard limit, never asked for it to be lifted. I've read somewhere online that you need to wait 4 years after reinstatement to request NPSL or just a higher limit. My score stays in the low to mid 600's anyway due to a couple of large collections, so I'm not stressing it. $4,700 is enough for me to run through there on any single transaction, and over the month I can make extra payments if I need more. If I make a payment online / in app it opens up my available credit immediately so it works out. I use mostof the platinum benefits and still manage to pull in significant MR points every year (100k+ per year) with my meager spending, so all in all it works out.

Here's a thread I found, but I can't recall where I read about the 4 year thing (maybe Reddit?) https://ficoforums.myfico.com/t5/Credit-Cards/Amex-Platinum-NPSL/td-p/6698095/page/3

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Amex Apollo Reinstatement process

Thanks @cardslayer for the reply and information.

So with the Apollo program you keep your history and the negative information would probably fall off your CR sooner.

Barclays: Arrival+ WEMC

Capital One: Savor WEMC, Venture X Visa Infinite

Chase: Freedom U Visa Signature, CSR Visa Infinite

Citibank: AAdvantage Platinum WEMC

Elan/US Bank: Fidelity Visa Signature

Credit Union: Cash Back Visa Signature

FICO 08: Score decrease between 26-41 points after auto payoff (11.01.21) FICO as of 5.23, EX: 812 / EQ: 825 / TU: 815