- myFICO® Forums

- FICO Scoring and Other Credit Topics

- Credit in the News

- Re: WMT suing Capital One

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

WMT suing Capital One

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: WMT suing Capital One

@Aim_High wrote:

@AlanGJP wrote:Would you want to be the lender to those people? I have a feeling this story is much deeper than reported. WM caters to low-income households with bad credit. I'm not trying to imply these are bad people, but they ARE risky for a bank.

I'm willing to bet WM customers have a much higher default rate and CO was re-negotiating based on that and WM refused.

Would you increase limits for those maxing their cards and making repeated late payments? Goodwill only goes so far.

I also have a hard time believing WM would back their own CC for the same reasons. Unless they can somehow push out a 35-40% APR with monthly fees.

Wow. There's a lot to unpack here, @AlanGJP.

"WM caters to low-income households with bad credit."

Where to even start with this? Obviously, there are some inaccurate assumptions. (1) WM shoppers are low income. (2) Low Income households have bad credit. (3) Walmart wants customers with bad credit. Say what?

All of these are false and demographics support the opposite.

(1) WM shoppers are low income.

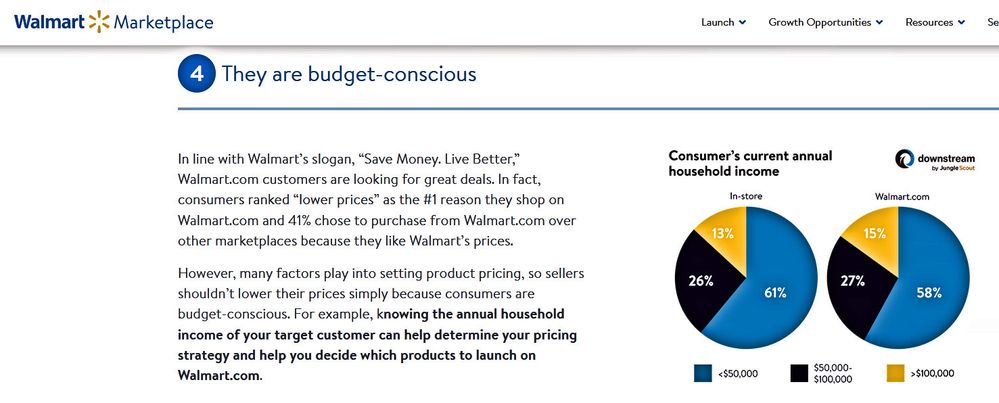

- Walmart's target demographic is not specific to income, race, sex, education, or credit score. While Walmart has a budget-conscious focus, that doesn't equate to low income. "The low prices and product variety at Walmart appeal to many different demographics, as they cater to the needs of the average consumer." (Source) Supporting data shows WM customers fairly evenly divided across the spectrum, including by income.

- According to 2022 data compiled by analytics firm Numerator and reported by Business Insider on 01/30/2023, Walmart's typical shopper in the US is a white woman between 55 and 64 years old, who is married and living in the suburbs of the Southeast. She typically has an undergraduate degree and earns about $80,000 per year. (The median US income last year was about $70K, so that customer earns more than median. census.gov)

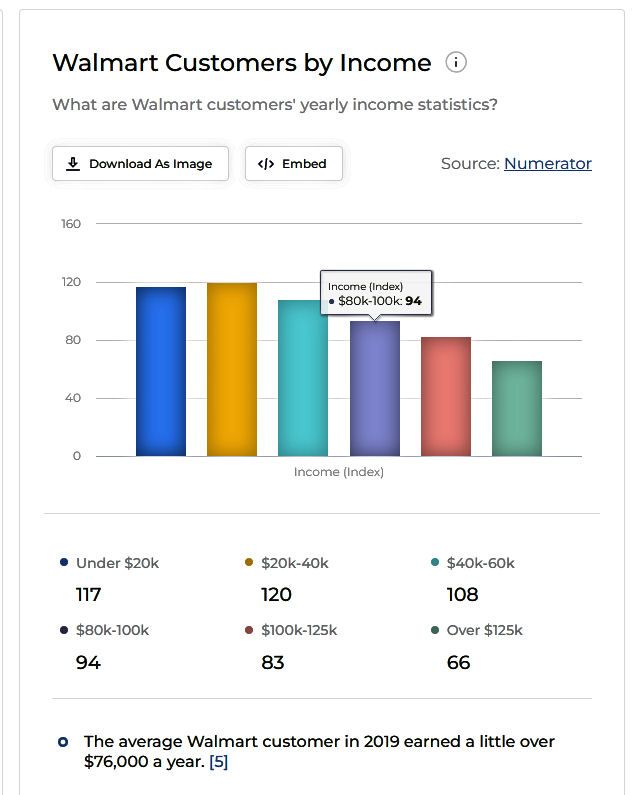

- This slide shows the income data of Walmart shoppers. Referencing the $70K median income, it's clear that even though the budget-conscious marketing may appeal slightly more to households below median than above median, there is a solid representation across a wide variety of incomes. (Source with other supporting slides.) Data is from 2019 so it shows a slightly lower income profile than above.

- Walmart's >own website< shows customer data from a wide range of incomes. The breakdown here is not as precise as the above and just uses $50K as a breakpoint, but still close to median income.

- This data is a little older (2012) when the median income was about $51K (census data) but still shows even representation of consumers across a wide range of incomes. (Source.)

(2) Low Income households have bad credit.

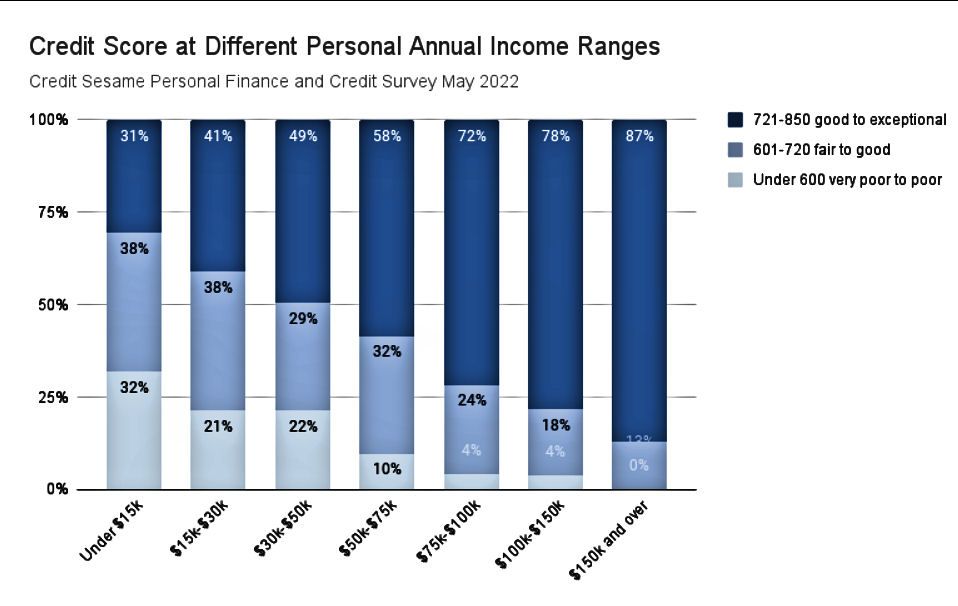

There is some weak correlation data between income and credit scores but correlation is not causation, per this Credit Sesame graphic and article on the subject. Again, to make this general assumption is an exaggeration of the facts, similar to the points above. There are low income households with high credit scores and high income households with low credit scores.

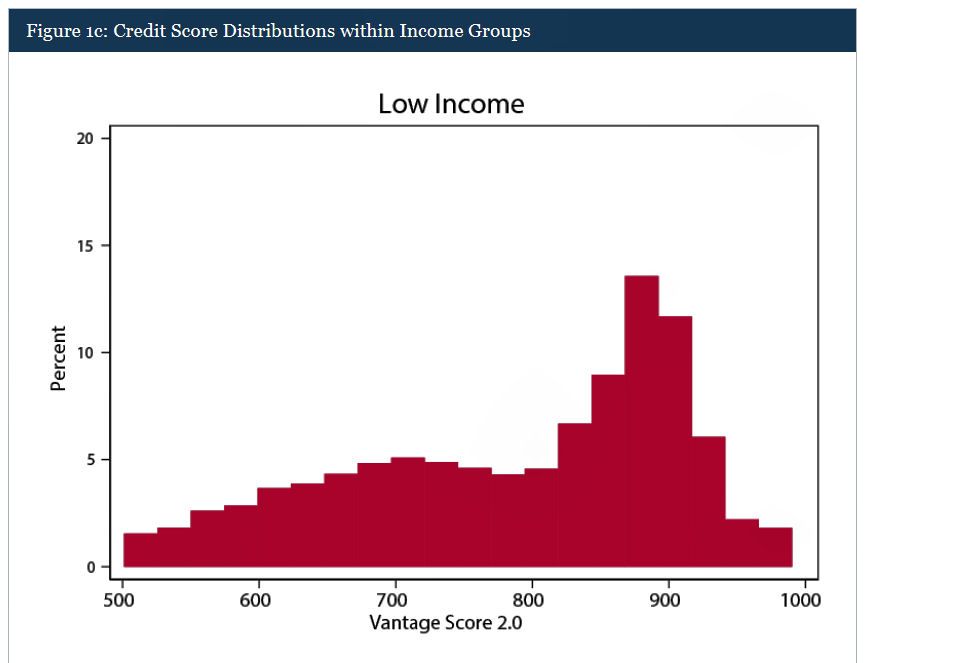

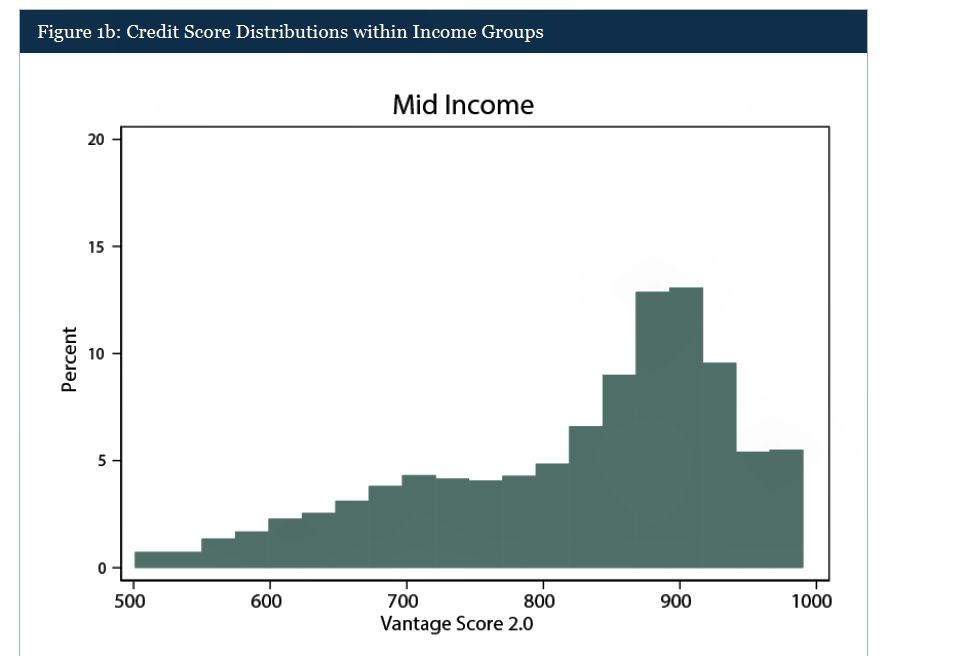

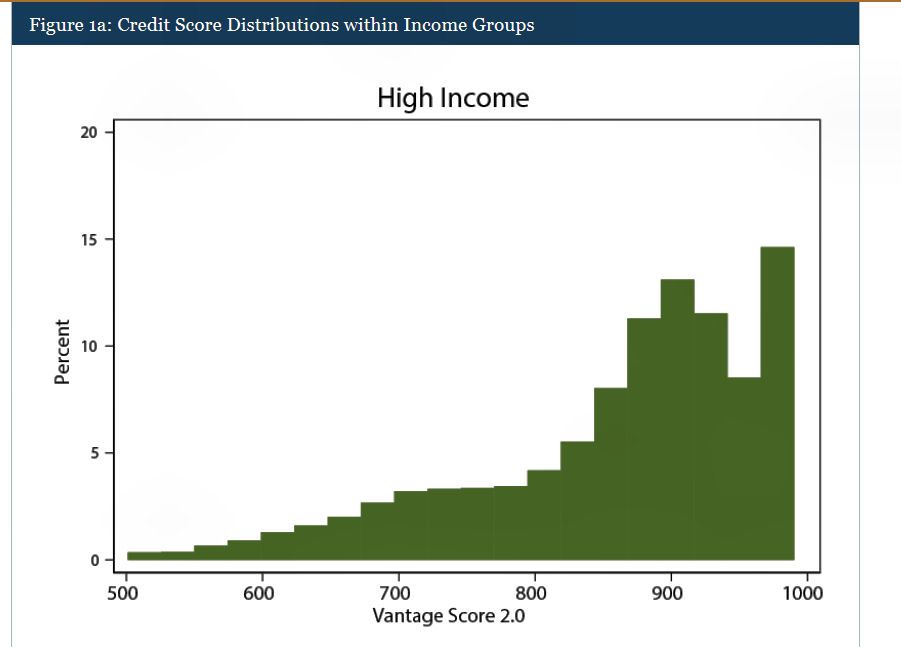

- Per this article published by the Federal Reserve, "we find a low correlation between credit score levels and income, with the correlation coefficient around 0.27 for income levels and 0.29 for log income." They did find a correlation as illustrated by histograms for various income groups and determined that "household income is moderately correlated with consumers' credit scores, and cross-sectional variations in household income account for a modest fraction of variations of credit scores." But in the end, they agreed with earlier studies that "income has only limited signaling power with respect to one's credit risks."

- As we know on My FICO, a low score isn't always an indication of irresponsibility or even distress. In some cases, a low score is simply from an undeveloped credit file. Those with lower incomes may have challenges qualifying for loans or credit cards based on a limited ability to repay, which would tend to keep scores suppressed. Implying that a low score always = irresponsible behavior does a disservice to those building their credit. Again, correlation is not causation. The Federal Reserve article above noted, "The additional explanatory power of income becomes minimal once a small set of credit history variables are accounted for."

(3) Walmart wants customers with bad credit.

Walmart targets (and successfully attracts) customers who are budget-conscious, regardless of their income or credit score.

"I'm willing to bet WM customers have a much higher default rate and CO was re-negotiating based on that and WM refused."

No. Capital One wasn't renegotiating. Per the original article, Walmart filed a lawsuit against Capital One for breach of contract. Default rate of WM customers was unrelated.

"Capital One failed to meet customer care standards in at least five “critical” categories, including delivering replacement cards to customers within five days and promptly posting transaction and payment information to cardholders’ accounts, according to the lawsuit."

"Would you increase limits for those maxing their cards and making repeated late payments? Goodwill only goes so far."

I think this is insulting for our members upthread as well as any other responsible consumers who have been declined for CLIs from Capital One - who may not be guilty of maxing out cards or paying late. While this may be the case, making a blanket accusation and without supporting data points is inappropriate. Community data points, on the other hand, do indicate Capital One is less generous with credit limits than some other lenders, and that is often regardless of profile.

"I also have a hard time believing WM would back their own CC for the same reasons."

To clarify, the upthread discussion wasn't about WM directly backing their own lending. We discussed their previous forays into the bankng segment but most recent links indicated a possible partnership through a FinTech or digital platform. The link to the "ONE" website above discloses that the affiliated bank is Coastal Community Bank. In this regard, a WM partnership is not much different that any other co-branded credit card or FinTech card.

Banking services provided by Coastal Community Bank, Member FDIC. Approved accounts are FDIC insured up to $250,000 per depositor. ONE is a financial technology company, not a bank. ONE card is issued by Coastal Community Bank pursuant to licensing by Mastercard® International.

Quite the comprehensive rebuttal. You could further add the latest research showing the percentage of Americans living paycheck to paycheck as well as their incomes. I just read an article today where my city was one of the top in the country where a 100k household income is no longer sufficient for a family of 3.

As for the question posed to me, whether I would want those types of people as customers, would really depend on my target demographic and business goals, now wouldn't it? Many of those people may be maxing out their cards, but they're paying them consistently. And at one time, a person's history with a lender meant something. It's one of the reasons people love credit unions. They take more into consideration before making a decision besides a credit score and utilization.

One of the reasons for the rise in alternate financing as well as Walmart's support of prepaid accounts like Green Dot is to cater to the underbanked/served. That does not automatically equate to low income. It's a well known fact that the younger generations do not trust the current financial system and favor fintechs and products like affirm, klarna, and after pay.

Bottom line is, there's gold in them thar hills and if Walmart ain't mining it, someone else will. Since Walmart doesn't carry the risk for the credit portfolio, why do they care if the lender increases theirs by increasing their exposure. Walmart only cares about $/transaction.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: WMT suing Capital One

@AlanGJP wrote:This is my last response to this thread, it was not my intention to steer this in this direction.

However... I will preface my response with this - You are correct in that I did not research their customer base and my response reflected my personal experience and not researched statistics. I've been to many Walmart's across the US and most that I've visited were run-down and the customers there reflected that, as did the management with empty shelves, dirty and broken/worn floors, open boxes on shelves, dirty bathrooms, etc) Of the ones that weren't that bad, they would still be considered poorly maintained/run by say Target's standards. (Their primary like-for-like brick-and-mortar competitor) Also, their return area appears focused on check cashing, money transfers and (again imo) methods of squeezing money out of people that have no other option. None of that matters to this thread however, and I shouldn't have gone there. This is personal experience, purely anecdotal, and my opinion may vary greatly from others AND especially their Walmart vs those I've visited - I'm sure in portions of the country my experience may have been very different. So I digress...

(* This is why I said their customers had poor credit - Walmart themselves claimed this to be the case.)

I don't care enough about this to continue down this hole any further, truthfully I'm sorry I responded at all.

It was a good discussion to have, @AlanGJP, and I certainly didn't mean my rebuttal as a personal attack on you or your observations. I understand the stereotype and am sure you aren't alone in those beliefs. On the other hand, when I see potential stereotypes and misunderstandings on the forums, I think it's good to point them out and providing the supporting evidence is the easiest way to turn the conversation from subjective to objective. I learned some things doing the research so thanks for bringing up the topic since those were your honest feelings. I hope other readers learned from the data as well. In particular, I think the links on the relationship of income to FICO is informative.

From the subjective side, yes, I've also seen some issues in Walmart but to be honest, I've seen issues in a lot of mainstream retail stores. But I don't associate store conditions with the consumer characteristics. I've seen issues in high-end department stores that I'm sure have a much more upscale clientele than Walmart.

I totally agree with the documented long-term tactics you reported that Walmart employs, same as the observations of @Royalbacon and @805orbust.

@Royalbacon wrote:It very well could just be Walmart is being Walmart and abusing their power to get better terms in their favor ...

In reference to the article and Walmart stating that their customers had bad credit, they didn't say all their customers had bad credit. They didn't even state the number of denials or the percentage. They simply complained that some customers were being turned down for credit due to underwriting. Perhaps Walmart hoped for 100% approval or 90% approval while Synchrony only approved 85%? We just don't know. Plus, in context, there is no comparison versus other retail card profiles. Did Walmart applicants have lower credit scores than those from retailers such as Target, Goodyear, Old Navy, or Victoria's Secret? Moreover, how do retail credit card applicants (as an overall group) compare to applicants for mainstream bank cards?

I disagree that the presence of check cashing, money order, money transfers in Walmart is just another way to squeeze more money out of customers. Many supermarkets and retailers have offered such services for a long time as a convenience for the unbanked or underbanked consumers. Sure, there are some fees but they aren't getting rich off of these services. I imagine if you asked the customers taking advantage of them, they would be grateful for the opportunity.

I won't re-post all the statistics here but I found a link (United Way of Oklahoma: United States data from 2017) that has a great breakdown on the various banking segments: unbanked; underbanked; fully banked. You might be surprised at the number of people in the US who don't have full access to traditional banking for one reason or another. Combined, the percentage of unbanked/underbanked in a single category can be as high as 20% to 50% of consumers in that subgroup. Even in high income households (over $75K), almost 14% are either unbanked/underbanked. So there appears to be real need for these services.

To summarize the link, the unbanked (no checking or savings) or underbanked (has at least one banking account but still had to use alternative financial services) consumer profiles are related to:

- Income: (higher income households become more fully banked)

- Age: (older consumers become more fully banked)

- Education: (better educated consumers become more fully banked)

- Race: (caucasion and asian consumers are more fully banked than others races)

- Disability: (consumers 25-64 who are disabled are less fully banked)

- Relationship: (single males or females are somewhat less fully banked than married couples)

- Single adult Head-of-Household: (families headed by a single adult, especially female, are less fully banked than single adults or married couples)

- Language: (consumers who only speak spanish are less fully banked)

Business Cards

Length of Credit > 40 years; Total Credit Limits >$900K

Top Lender TCL - Chase 156.4 - BofA 99.7 - AMEX 95.0 - CITI 94.5 - NFCU 80.0

AoOA > 30 years (Jun 1993); AoYA (Feb 2024)

* Hover cursor over cards to see name & CL, or press & hold on mobile app.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: WMT suing Capital One

Judge ruled today that Wal-Mart can drop CapOne as card issuer for failing on customer service metrix

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: WMT suing Capital One

Appreciate this update @Scottisthename.

Looks like CapOne will be busy with Discover and trying to hold onto WMT.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: WMT suing Capital One

Walmart had to know how Cap1 handled credit cards. Do not believe that Walmart thought they were going to change Leopard Spots to Tiger Stripes.

One thing about Cap1 is they have been consistently themselves over all the years. No one needed a road map on how they operated. Also, we discussed it around here, Cap1 has helped many new or rebuilders in credit get a new start so Walmart has to be after the Gold (speculation).

More to this ... believe the posters that said there is "gold in them thar hills" ...

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: WMT suing Capital One

@TrapLine wrote:Walmart had to know how Cap1 handled credit cards. Do not believe that Walmart thought they were going to change Leopard Spots to Tiger Stripes.

One thing about Cap1 is they have been consistently themselves over all the years. No one needed a road map on how they operated. Also, we discussed it around here, Cap1 has helped many new or rebuilders in credit get a new start so Walmart has to be after the Gold (speculation).

More to this ... believe the posters that said there is "gold in them thar hills" ...

Capital One agreed to do things and then, didn't do those things. CapOne agreed to provide customer service in line with what Walmart wanted, but then didn't provide the services as outlined in the contract.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: WMT suing Capital One

@FrankenBeans wrote:

@TrapLine wrote:Walmart had to know how Cap1 handled credit cards. Do not believe that Walmart thought they were going to change Leopard Spots to Tiger Stripes.

One thing about Cap1 is they have been consistently themselves over all the years. No one needed a road map on how they operated. Also, we discussed it around here, Cap1 has helped many new or rebuilders in credit get a new start so Walmart has to be after the Gold (speculation).

More to this ... believe the posters that said there is "gold in them thar hills" ...

Capital One agreed to do things and then, didn't do those things. CapOne agreed to provide customer service in line with what Walmart wanted, but then didn't provide the services as outlined in the contract.

Hear what you are saying but do we really know that Cap1 did not provide the service? This may be a lever by Walmart and a hard one to prove! As I recall, probably from this site, Walmart walked away from another financial just not to long ago?! Citi Bank? It makes me wonder?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: WMT suing Capital One

@TrapLine wrote:

@FrankenBeans wrote:

@TrapLine wrote:Walmart had to know how Cap1 handled credit cards. Do not believe that Walmart thought they were going to change Leopard Spots to Tiger Stripes.

One thing about Cap1 is they have been consistently themselves over all the years. No one needed a road map on how they operated. Also, we discussed it around here, Cap1 has helped many new or rebuilders in credit get a new start so Walmart has to be after the Gold (speculation).

More to this ... believe the posters that said there is "gold in them thar hills" ...

Capital One agreed to do things and then, didn't do those things. CapOne agreed to provide customer service in line with what Walmart wanted, but then didn't provide the services as outlined in the contract.

Hear what you are saying but do we really know that Cap1 did not provide the service? This may be a lever by Walmart and a hard one to prove! As I recall, probably from this site, Walmart walked away from another financial just not to long ago?! Citi Bank? It makes me wonder?

According to the linked article (up thread), Walmart provided the documentation (which I think wasn't difficult). Capital One didn't respond to a number of cardholders in the specified amount of time (things like replacing lost cards, etc) which cost Walmart money. Walmart was able to provide proof that Capital One did it repeatedly and more than the agreed upon number of times allowable in the contract.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: WMT suing Capital One

@TrapLine wrote:Walmart walked away from another financial just not to long ago?! Citi Bank?

Synchrony, not long before COVID hit.

FICO 8 (EX) 846 (TU) 850 (EQ) 850

FICO 9 (EX) 850 (TU) 850 (EQ) 850

$1M+ club

Artist formerly known as the_old_curmudgeon who was formerly known as coldfusion