- myFICO® Forums

- Types of Credit

- Credit Cards

- Citi CLD

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Citi CLD

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

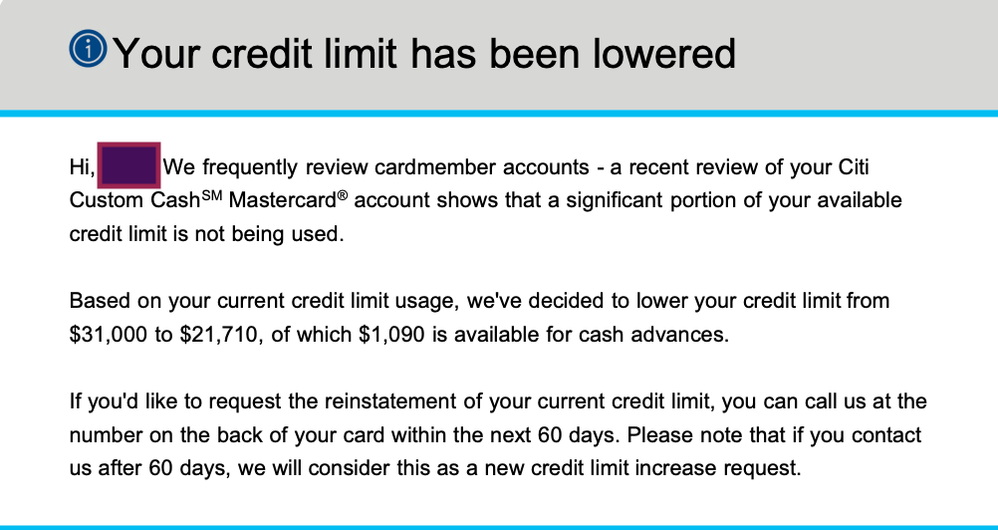

Citi CLD

Just checking account and noticed Citi lowered the CL on one of my custom cash cards. Scores are well into the 800's. Not sure if other s will see this or not. It appears I can call and request for the limit to be retained, but honestly not sure if I will. Keep your eyes open as this is a first for citi for me. Has nothing to do with debt or marks on credit as mentioned near 830ish credit score. Appears citi is slashing limits like other banks as well. Card sees 250-400 use a month

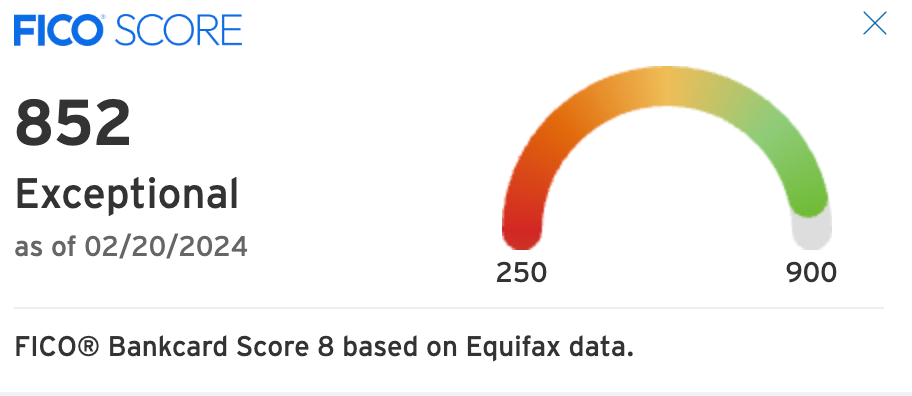

Score from Citi's site decided to take a screen shot of it as well.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Citi CLD

Bah. Humbug.

Stinkers.

FICO 8 (EX) 846 (TU) 850 (EQ) 850

FICO 9 (EX) 850 (TU) 850 (EQ) 850

$1M+ club

Artist formerly known as the_old_curmudgeon who was formerly known as coldfusion

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Citi CLD

@coldfusion wrote:Bah. Humbug.

Stinkers.

right.. think i will make that call to see if they will restore it.. no one ever likes that happening and they say call if you want it so i will call although slashed CL is enough we all want to most.. Will let you know of outcome

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Citi CLD

submitted to credit team for review. CS agent said it has been happening for last 3 days now across many peoples accounts so appears fairly new. See what comes back but was not instant to have limit reinstanted but certainly no hard pulls

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Citi CLD

Got the same notice about my Dividend card, can't quite remember but 25-30% reduction. I didn't bother to call as the current limit is fine (far more than I would ever use the card).

I had assumed it was lack of use (the letter said that I hadn't been utilizing the credit limit, my spend was a few hundred per year), but apparently @CreditCuriosity $250 a month isn't enough either. Shades of Capital One of a few years ago, actually have to utilize the limit to keep it!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Citi CLD

@longtimelurker wrote:Got the same notice about my Dividend card, can't quite remember but 25-30% reduction. I didn't bother to call as the current limit is fine (far more than I would ever use the card).

I had assumed it was lack of use (the letter said that I hadn't been utilizing the credit limit, my spend was a few hundred per year), but apparently @CreditCuriosity $250 a month isn't enough either. Shades of Capital One of a few years ago, actually have to utilize the limit to keep it!

Thanks for the DP.. I assume we are going to see a lot more posts like this especially what CS agent stated. I am guessing on the AF cards we likely won't see as many DP as one is paying AF on say AA card or Prestige, etc.. We shall see though. I honestly wasn't going to call, but if they stop offering my loans on CC at cheap rates that people could take up then one might want that cushion for those loans although not me. Maybe they would not of done AA if I paid them for something I didn't need ![]() . I recall we both got the Cap1 treatment at same time several years back as well where I opted to close mine and believe you didn't take it as personally. I love my custom cash cards and as mentioned way above cap of spending a month so they will certainly be kept only hit one of them other was a 13k CL and that is more than I need. Asked for limit back from science and DPs for this forum as can be seen my Score isn't the issue. Think I am carrying 400 on another CC is all other than house/car payment I am well off in the financial situation and dti/payments

. I recall we both got the Cap1 treatment at same time several years back as well where I opted to close mine and believe you didn't take it as personally. I love my custom cash cards and as mentioned way above cap of spending a month so they will certainly be kept only hit one of them other was a 13k CL and that is more than I need. Asked for limit back from science and DPs for this forum as can be seen my Score isn't the issue. Think I am carrying 400 on another CC is all other than house/car payment I am well off in the financial situation and dti/payments

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Citi CLD

Nothing on my AA exec. but a DP for this card is it's getting very heavy use $5k - $15k per month. I'm a small sample though as I only have 4 personal cards.

Based on the DPs we see now, it's use it or lose it, which would make sense.

I think the days of banks giving out CLIs like Chiclets and then nobody using it might be over.

IMO, Banks can keep the same reserve and spread out the CLI decrease for CLI to individuals that use the card more.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Citi CLD

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Citi CLD

@longtimelurker wrote:Got the same notice about my Dividend card, can't quite remember but 25-30% reduction. I didn't bother to call as the current limit is fine (far more than I would ever use the card).

I had assumed it was lack of use (the letter said that I hadn't been utilizing the credit limit, my spend was a few hundred per year), but apparently @CreditCuriosity $250 a month isn't enough either. Shades of Capital One of a few years ago, actually have to utilize the limit to keep it!

Nothing has happened to my Dividend CL yet (keeping fingers crossed). I only spent several hundred dollars on it last year. The previous year I maxed out the rewards with a little over $6000 in spend. At least Citi is giving the opportunity to request a limit restoration. Best wishes to @CreditCuriosity for a positive outcome.

FICO8:

VantageScore3:

Inquiries (n/12, n/24):

AAoA: 11 yrs | AoORA: 36 yrs | AoYRA: 12 mos | New Accounts: 0/6, 0/12, 2/24 | Util: 1% | DTI: 1%

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Citi CLD

I, too, received a CLD on my Double Cash. It was reduced - from $66,200 to $47,100 - of which $0 is avilable for cash advances.

As of late, I've actually been spending more on this card $2k to $4k monthly in addition to pretty much anything that is not streaming or ACH only is on this card. I pay off weekly.

I will see if they can restore limit, and if they don't, then I'll have to decide whether it's worth keeping. I've had this card for nearly 9 years. If only Citi would consider reallocating limits - I'd probably just move a chunk to my Costco card and close the DC.

Business is business, so I get it - but it doesn't mean that I have to like it.