- myFICO® Forums

- Types of Credit

- Auto Loans

- Questions about Paying Auto Loan & Interest Accumu...

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Questions about Paying Auto Loan & Interest Accumulated

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Questions about Paying Auto Loan & Interest Accumulated

So for context

- I have an auto loan which does not have early payment penalties.

- I originally got the car with an interest rate of 15.86% at about 25,000

- My current prinicipal balance on my car is about 23700.

For the first month the daily interest was about 10.76 a day. So my first scheduled payment would've been 322 to interest and about 220 to the prinicipal. I decided to pay a week early and saw that only 260 went to interest and 280 went to principal.

This is the how contract words daily interest:

We will figure the Finance Charge on a daily basis at the Annual Percentage Rate on the unpaid part of the Amount Financed

So in theory I could reduce this finance charge paying faster and adding more on top of it.

This has me thinking if I pay a week early or every 2 weeks my entire car payment won't I be putting the majority into the principal and substantially less to interest?

Starting Score:Ex: 450, Eq: 490, Tr: 510

Current Score:

Ex: 543, Eq: 538, Tr: 550

Goal Score:

750

Take the myFICO Fitness Challenge

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Questions about Paying Auto Loan & Interest Accumulated

@72jnse wrote:So for context

- I have an auto loan which does not have early payment penalties.

- I originally got the car with an interest rate of 15.86% at about 25,000

- My current prinicipal balance on my car is about 23700.

For the first month the daily interest was about 10.76 a day. So my first scheduled payment would've been 322 to interest and about 220 to the prinicipal. I decided to pay a week early and saw that only 260 went to interest and 280 went to principal.

This is the how contract words daily interest:

We will figure the Finance Charge on a daily basis at the Annual Percentage Rate on the unpaid part of the Amount FinancedSo in theory I could reduce this finance charge paying faster and adding more on top of it.

This has me thinking if I pay a week early or every 2 weeks my entire car payment won't I be putting the majority into the principal and substantially less to interest?

I think you'll find unless you pay a week earlier than you did the previous time for every payment, the interest charges will revert to a more normal P/I split.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Questions about Paying Auto Loan & Interest Accumulated

@Horseshoez wrote:

@72jnse wrote:

For the first month the daily interest was about 10.76 a day. So my first scheduled payment would've been 322 to interest and about 220 to the prinicipal. I decided to pay a week early and saw that only 260 went to interest and 280 went to principal.

This is the how contract words daily interest:

We will figure the Finance Charge on a daily basis at the Annual Percentage Rate on the unpaid part of the Amount FinancedSo in theory I could reduce this finance charge paying faster and adding more on top of it.

This has me thinking if I pay a week early or every 2 weeks my entire car payment won't I be putting the majority into the principal and substantially less to interest?

I think you'll find unless you pay a week earlier than you did the previous time for every payment, the interest charges will revert to a more normal P/I split.

The amount of interest is based on the time between payments, not the absolute date the payment is made. I agree with @Horseshoez, if you make every payment a week early, the time between payments is one month, and you'll see the "normal" amount of interest. If you pay half a payment every two weeks, you'll be making an extra payment per year which will help pay off the loan faster, and of course as the balance goes down, the P/I split becomes more principal, less interest.

AoOA: closed: 36 years, open: 25 years; AAoA: 11.8 years

Amex Gold, Amex Green, Amex Blue, Amex ED, Amex Delta Gold, Amex Hilton Surpass, BoA Platinum Plus, Chase Freedom Unlimited, Chase Amazon, Chase CSP, Chase United Explorer, Citi AA Plat, Sync Lowes, Sync JC Penney - total CL 145k

Loans: Chase car loan (35k/6yrs 0.9%)

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Questions about Paying Auto Loan & Interest Accumulated

Starting Score:Ex: 450, Eq: 490, Tr: 510

Current Score:

Ex: 543, Eq: 538, Tr: 550

Goal Score:

750

Take the myFICO Fitness Challenge

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Questions about Paying Auto Loan & Interest Accumulated

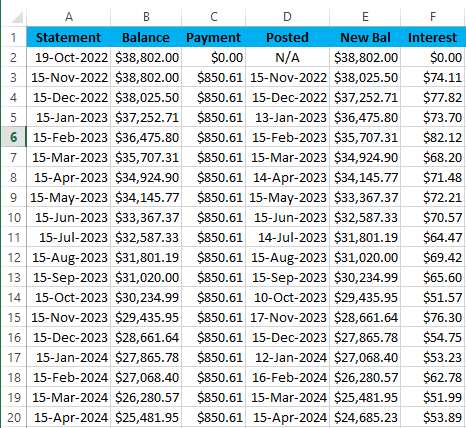

Here is my rolling track of my payments:

| Statement | Balance | Payment | Posted | New Bal | Interest |

| 19-Oct-2022 | $38,802.00 | $0.00 | N/A | $38,802.00 | $0.00 |

| 15-Nov-2022 | $38,802.00 | $850.61 | 15-Nov-2022 | $38,025.50 | $74.11 |

| 15-Dec-2022 | $38,025.50 | $850.61 | 15-Dec-2022 | $37,252.71 | $77.82 |

| 15-Jan-2023 | $37,252.71 | $850.61 | 13-Jan-2023 | $36,475.80 | $73.70 |

| 15-Feb-2023 | $36,475.80 | $850.61 | 15-Feb-2023 | $35,707.31 | $82.12 |

| 15-Mar-2023 | $35,707.31 | $850.61 | 15-Mar-2023 | $34,924.90 | $68.20 |

| 15-Apr-2023 | $34,924.90 | $850.61 | 14-Apr-2023 | $34,145.77 | $71.48 |

| 15-May-2023 | $34,145.77 | $850.61 | 15-May-2023 | $33,367.37 | $72.21 |

| 15-Jun-2023 | $33,367.37 | $850.61 | 15-Jun-2023 | $32,587.33 | $70.57 |

| 15-Jul-2023 | $32,587.33 | $850.61 | 14-Jul-2023 | $31,801.19 | $64.47 |

| 15-Aug-2023 | $31,801.19 | $850.61 | 15-Aug-2023 | $31,020.00 | $69.42 |

| 15-Sep-2023 | $31,020.00 | $850.61 | 15-Sep-2023 | $30,234.99 | $65.60 |

| 15-Oct-2023 | $30,234.99 | $850.61 | 10-Oct-2023 | $29,435.95 | $51.57 |

| 15-Nov-2023 | $29,435.95 | $850.61 | 17-Nov-2023 | $28,661.64 | $76.30 |

| 15-Dec-2023 | $28,661.64 | $850.61 | 15-Dec-2023 | $27,865.78 | $54.75 |

| 15-Jan-2024 | $27,865.78 | $850.61 | 12-Jan-2024 | $27,068.40 | $53.23 |

| 15-Feb-2024 | $27,068.40 | $850.61 | 16-Feb-2024 | $26,280.57 | $62.78 |

| 15-Mar-2024 | $26,280.57 | $850.61 | 15-Mar-2024 | $25,481.95 | $51.99 |

| 15-Apr-2024 | $25,481.95 | $850.61 | 15-Apr-2024 | $24,685.23 | $53.89 |

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Questions about Paying Auto Loan & Interest Accumulated

@72jnse wrote:

By payment every 2 weeks, I mean a full payment. So 540 twice a month.

That would pay off the loan in less than half the original time so you would end up paying far less in total interest over the life of the loan than originally plannned. If you can afford to make those double payments, then go for it.

AoOA: closed: 36 years, open: 25 years; AAoA: 11.8 years

Amex Gold, Amex Green, Amex Blue, Amex ED, Amex Delta Gold, Amex Hilton Surpass, BoA Platinum Plus, Chase Freedom Unlimited, Chase Amazon, Chase CSP, Chase United Explorer, Citi AA Plat, Sync Lowes, Sync JC Penney - total CL 145k

Loans: Chase car loan (35k/6yrs 0.9%)

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Questions about Paying Auto Loan & Interest Accumulated

Well that was fugly; this is better:

What is unsaid is my first payment was due 05-Dec-2022 and each subsequent due date is the 5th of every month; as you can see, I made my first payment nearly three weeks early (but roughly a month after I bought my Tacoma), and the interest portion of my payment was right in line with other months; had I paid on the actual due date I would have expected to have been charged about $115 in interest instead of the $74.11.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Questions about Paying Auto Loan & Interest Accumulated

The way I see this, is as long as you avoid paying every month, but instead aim for every 3 weeks.

You can in theory [ and hopefully in practice] be able to keep battling interest in a way that more and more progressively goes to principal.

Fun thinking about it. And mathematically if someone can afford it, another potential way to save money on interest.

Starting Score:Ex: 450, Eq: 490, Tr: 510

Current Score:

Ex: 543, Eq: 538, Tr: 550

Goal Score:

750

Take the myFICO Fitness Challenge

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Questions about Paying Auto Loan & Interest Accumulated

@72jnse wrote:The way I see this, is as long as you avoid paying every month, but instead aim for every 3 weeks.

You can in theory [ and hopefully in practice] be able to keep battling interest in a way that more and more progressively goes to principal.

Fun thinking about it. And mathematically if someone can afford it, another potential way to save money on interest.

The thing about interest is not all interest rates are equal; in your case accelerating your payments will help pay down your balance quicker and reduce the interest you ultimately pay, in my case I have absolutely zero desire to pay down my loan any faster than I am. What is the difference? As alluded to above, it is the rate; I managed to snag a loan at 2.49% for 48 months, and yet I have savings and investments paying quite a bit more than that, so it would be dumb for me to put more money into paying down the loan. Your 15.86% interest rate strongly suggests you should either refinance to a lower rate or pay that sucker off as soon as possible.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Questions about Paying Auto Loan & Interest Accumulated

Oh yeah, I meant for people with credit like me.

Starting Score:Ex: 450, Eq: 490, Tr: 510

Current Score:

Ex: 543, Eq: 538, Tr: 550

Goal Score:

750

Take the myFICO Fitness Challenge