- myFICO® Forums

- Welcome to the myFICO® Forums

- Take the myFICO Fitness Challenge!

- November 2023 Check-In Thread

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

November 2023 Check-In Thread

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

November 2023 Check-In Thread

I know you are all hard at work with your credit goals. Have you progressed as far as you hoped? Were there any unforeseen expenses that cropped up and may have thrown you off schedule?

As a reminder, participation in these monthly check-ins is optional but encouraged. The goal is to help keep you on track, so feel free to post your progress updates here. This is a no-judging zone; feel free to say what's keeping you up at night or give yourself a Kudo for having it all together.

Did you hit any potholes or speedbumps? Achieve some milestones, either small or mighty? Change your goals or add new ones?

Let us know how you're doing!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: November 2023 Check-In Thread

November 1 3B pull scores are still trending generally upward.

Eq 8 778 and Ex 8 777 are getting dangerously close to my goal of having all three FICO 8 scores at 780+. TU still lags behind, and I have a recent inquiry on TU that doesn't help.

Four scores are 800+, Eq Bankcard 8 803, Ex Bankcard 8 806, Eq Bankcard 9 803, and TU Bankcard 9 800.

(I had two 800+ scores last month and none for a couple years prior to that.)

Eq 10 is my lowest score at 744. I think this is the first time in the several years I've been tracking them that every single score is 740+.

Average across all 40 scores is up 4.525 points.

Big jumps in TU 4 +25 to 770, TU Auto 4 +25 to 777, and TU Bankcard 4 +24 to 768. All of my 5/4/2 variations (&3) did well. These are scores that have usually lagged behind for me.

EQ8 809, TU8 790, EX8 797 as of May 11

EQ8 809, TU8 790, EX8 797 as of May 11- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: November 2023 Check-In Thread

Another page on the calendar, another month of gardening. Down to 1/12 right now and trying to hold steady.

I moved a couple of months ago and had some high utilization from furniture and other household expenses. I do PIF, but only on the due date as I'd rather earn interest on the funds than pay early. The temporary result was a bump in utilization and a 20+ point drop in my scores. It bounced back this month.

For now, just waiting to see if AmEx will give me a decent offer to upgrade my BCE to the BCP…

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: November 2023 Check-In Thread

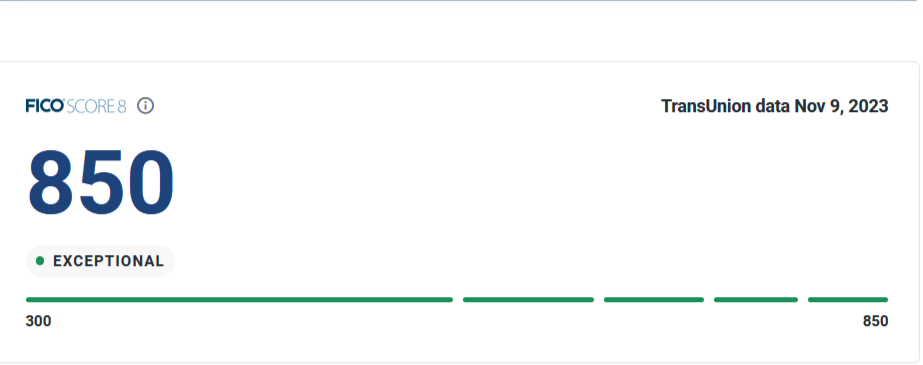

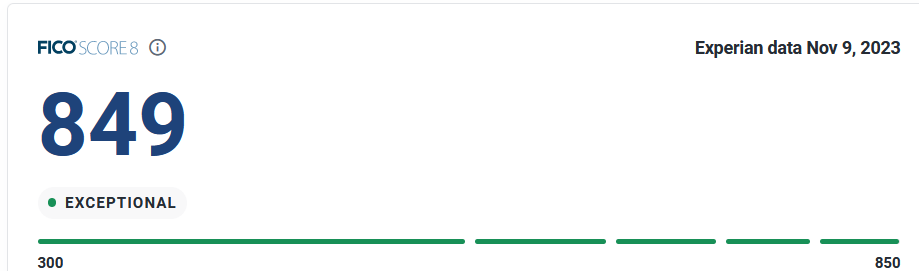

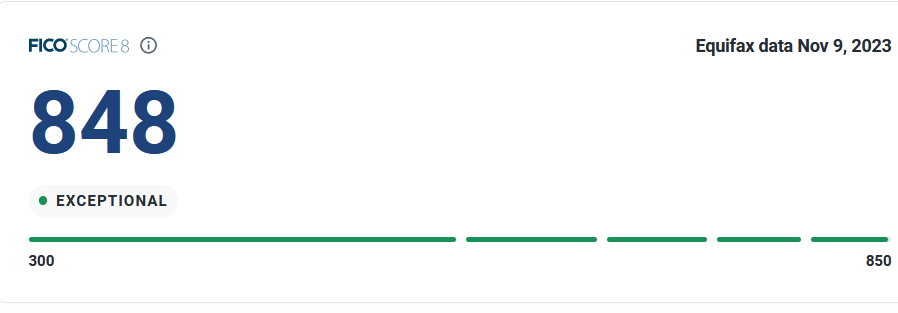

Another boring month of gardening and watching paint dry, er watching my scores do just about nothing. I have a pretty tight dime grouping in my scores. I got a +3 bump on EQ F8 to 848, EX and TU remain at 847 for now. I am not sure why (other than aging) I got the 3 point bump on EQ today. I expect that both will hit 850 on 11/9 when my last scoreable INQ turns a year old. I don't have a way to see TU right away, so I'll have to wait a couple weeks until Discover updates after the statement closes on 11/25. I wish I had a way to track my TU F8 the way I can with the other bureaus.

I don't plan to app for anything, so my 850s should be around for a minute. I'm at the mercy of time passing to achieve 850 on EQ. I don't have any scoreable INQs there.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: November 2023 Check-In Thread

Well, I hit 850 on one and 849 on another when that last INQ turned a year old. Cruel move there, EX! I now have to figure out what the passage of time threshold is for the youngest account to get the last point on EX and the last two on EQ. 15 months?

Starting Score: 469

Starting Score: 469