- myFICO® Forums

- Types of Credit

- Student Loans

- Confused by my SL charge off- need help interpreti...

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Confused by my SL charge off- need help interpreting convo w/creditor, & next steps

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Confused by my SL charge off- need help interpreting convo w/creditor, & next steps

This will be a mouthful, proceed at your own risk ![]() My C.O. seems to have changed itself, and I don't understand why- that's in the shorter 2nd post.

My C.O. seems to have changed itself, and I don't understand why- that's in the shorter 2nd post.

My student loan debt was never a "loan," federally or privately. Called a "tuition loan," as I understand. I simply got into a bad situation my last semester, planned to pay it off a few months later, and.. well, didn't work out that way.

After a few years of small payments, the (school) emailed me a payment schedule. It was too high and < 2 weeks into that, they (the rep) decided the entire plan had gone on too long, closed options and sent it to a debt collector. The collector had even higher monthly payment options, done < 12 months. They wouldn't address how it would update with the bureaus.. and said I couldn't talk to the school about it anymore (didn't think that was true, but guessing collectors probably spend a lot of time in gray areas).

Did try talking to the school a couple times back then and they referenced me back to the collector. So, it went a year without payments. Not their responsibility, but since I didn't know how to handle it and since they (collector 1) wouldn't take any amount (I offered to double my original payment multiple times, they just wanted me to make up the difference in month 2), so it went nowhere.

This repeats with collector 2. Pretty much exact repeat of collector 1. 6 months in, as the year ends, it becomes a charge off. ![]()

I could've handled this better, and perhaps should've forced the school to have some sort of contact with me, rather than brush me off onto unhelpful agents.

After the C.O. notification, read I might have 30 days or less to try and make a deal with the creditor before it was sold off (not true here, see below). Results seem mixed on whether or not you can "negotiate" a settlement in these situations, especially if you're trying to have the charge off marked "paid as agreed" instead of "settled."

Spoke to the rep at the school who originally took my payment plan off the table a few years ago. They said multiple things that made me doubt their credibility/knowledge regarding credit, and what their promises might actually mean. Not being a credit analyst and making a reference to their credit department more than once, some of it is probably an estimate. Wondering about enough of the points to dig in further, though..

This point is mine alone- the charge off amount includes a "fee" somewhere in the fine print of when I enrolled, about a debt collectors fee. That is added to my original balance. It assumes I have never paid down any of the original balance (incorrect) and adds $1k on top of it. So it's aboute a $2500 difference. The rep multiple times mentioned the actual amount I do owe. Which would it be, the charge off amount reported, or what they say is needed for this to be "paid off." What if the amount changes next time I talk to them, with no outside buyer of the debt involved (none to date)- is that allowed?

-They said they do not negotiate the debt at all (standard perhaps, though isn't that the start of a stiff negotiation?)

-The payment has to be made all at once (reasoning was that multiple payments put them at risk of a chargeback, a single charge did not. Which makes no sense to me.. maybe multiple charges looks more fishy (?), but couldn't one chargeback a single payment also? Not considering this, just illustrating my concern with their knowledge of the topic, before I proceed.

-They do not offer a pay for delete option, but would've during the delinquency process with the collectors (which they did not address when I called them and said it was between me and the collectors).. wow that would've been good to know at the time. They are willing to work with the bueaus and mark it as "paid in full" I believe, but it "won't delete").

-The debt stays at the university "forever," they never sell it to a creditor. Is forever possible? Maybe you can't take another class before paying off old debt.. but nothing stays on a report forever ? Can they update your DOLA for life, so it never falls off? Seems impossible.

If they never sell it and it stays forever, wouldn't it fall off by itself? I'm not willing to trade that time for the blemish to sit there, but.. don't understand. From my understanding, if it was "paid," fico 9 has minimal if any penalty against your score for that, all the more reason to have it paid.

-Said "your transunion record is there for your whole life, nothing is ever gone." Specifically pointed to TU. Well, that's not true..

-Credit bureaus are often behind in updating reports and it "often takes 8 months for that to show up on a report. Is 8 months "standard"? Delays happen, but.. standard?

Takeaways? I assume negotiating isn't really an option. Their policy is against pay for delete- is a post payment goodwill letter an unlikely option? Know it can be frowned on by the bureaus to have it reported if it wasn't really an "error." Are inaccurate collections agent statements grounds for any sort of "legit" error in disputing the debt (pre or post payment)?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Confused by my SL charge off- need help interpreting convo w/creditor, & next steps

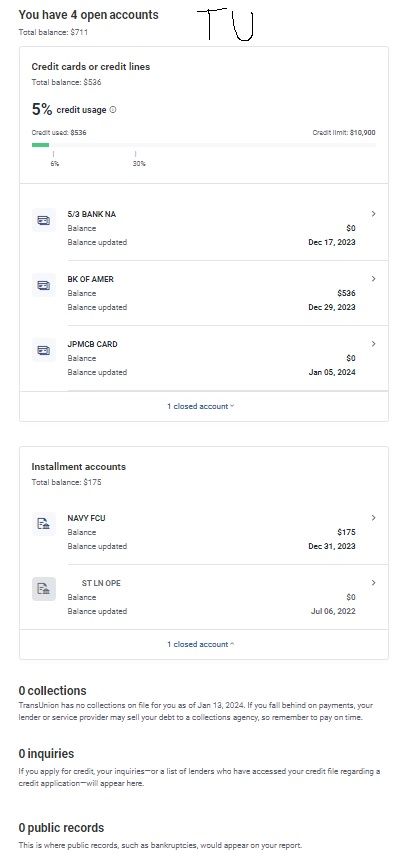

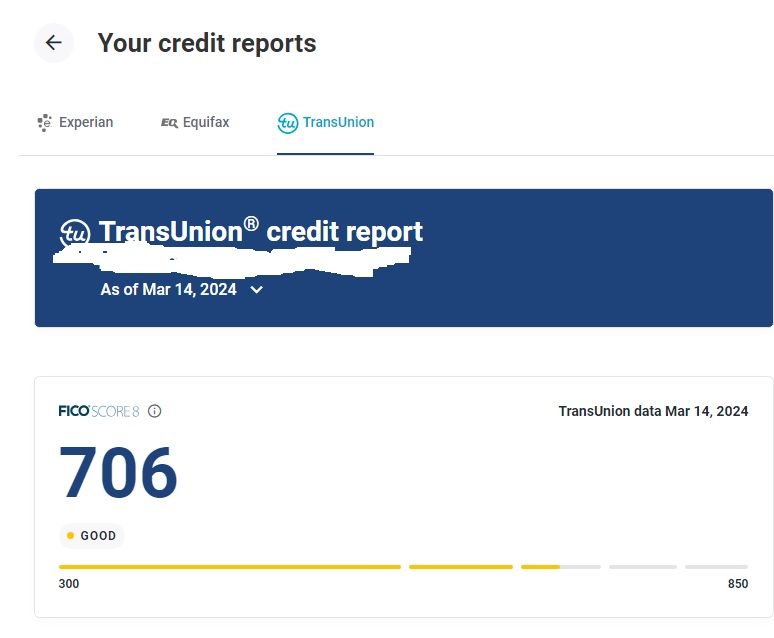

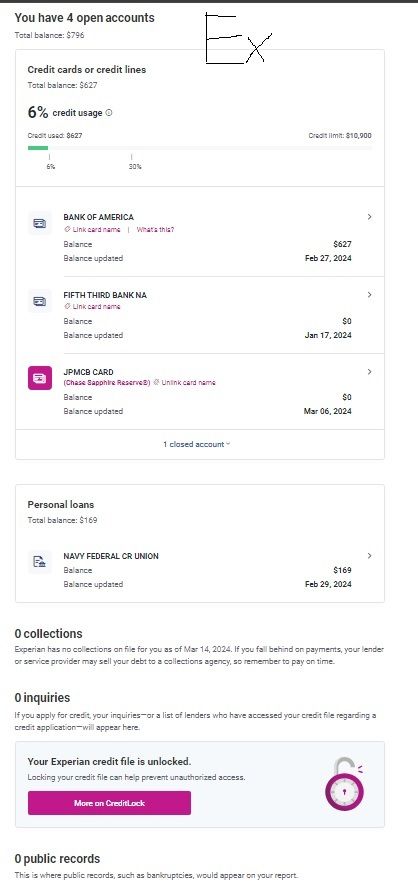

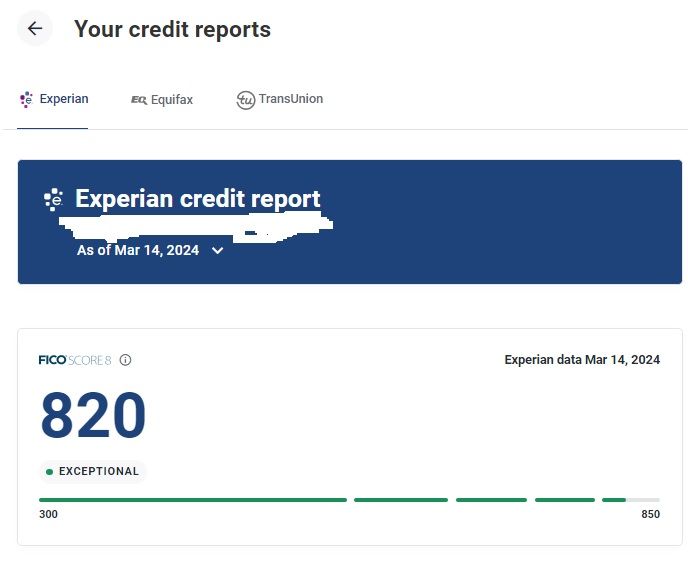

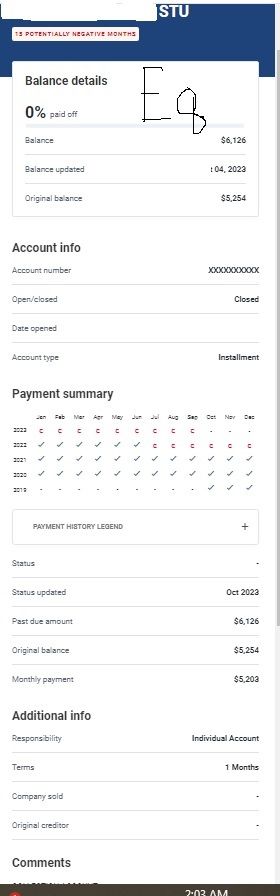

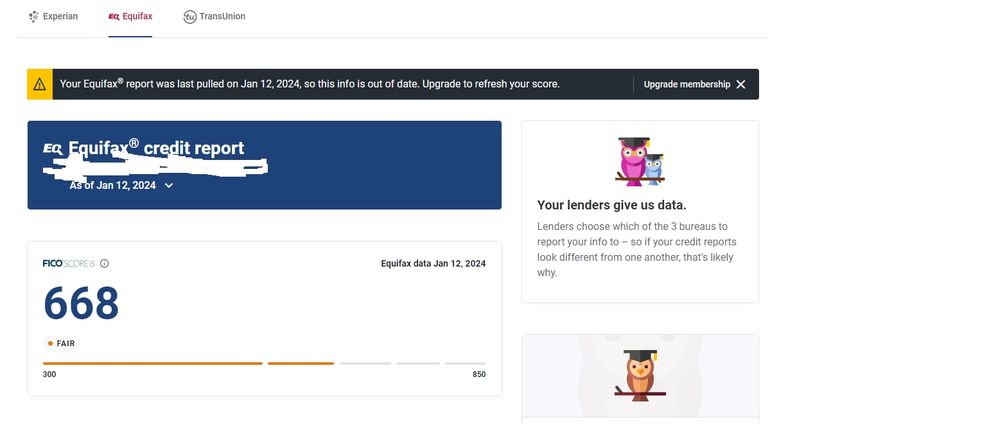

4 days after talking with the rep (gotta be a coincidence?)- (and I just found out today, about 25 days later.. I log on to get screen grabs for here since I am confused about that discussion and.. it no longer reports on my Ex. It reports on TU and EQ, though differently on each.

Paid 100% on TU, 0% on EQ. EQ and EX were about the same score last time, EX went up 120 points, to about where it was before any of this went to collections, showed up on report, etc. These are all same as current- EQ updated has same info as before.

Have no idea what's going on, why it shows this way on the other 2, or what changed I do want to capitalize on apping for a new card if EX is clean for now. Maybe a cli for my boa on TU also.

I hoped to do a balance transfer to a card and have it report within a month so my scores would go up and I'd quality for something better, but from reading, it could definitely take more time to update and that's risky.

So, why is reporting differently to each bureau?

Is it telling me the difference between paid in full (TU) and 0% paid (EQ) is the 20 point score increase I would get if EQ read the same? Cause that would not be very motivating..

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Confused by my SL charge off- need help interpreting convo w/creditor, & next steps

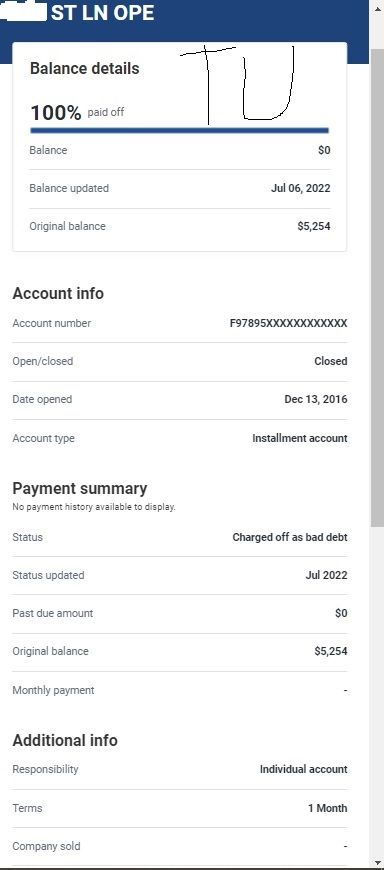

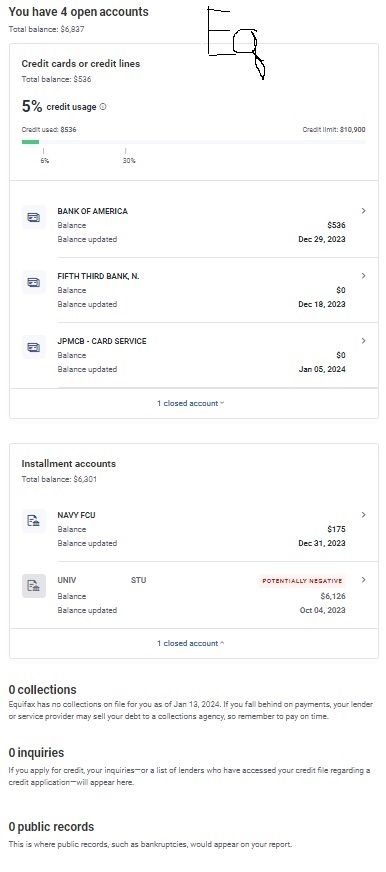

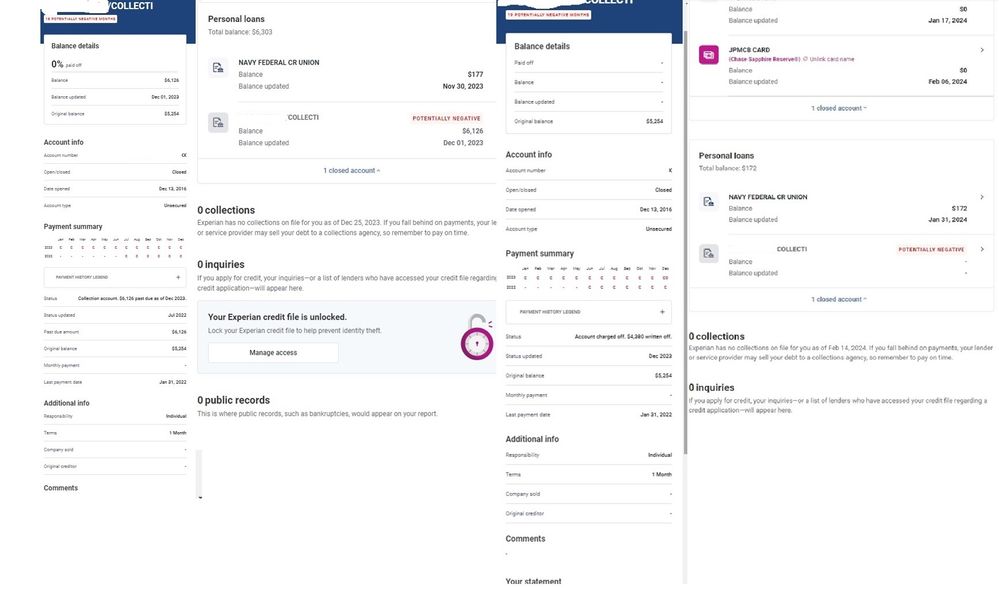

I can't speak to how this particular lender handles recovery of their charge-offs, but I do notice a couple of things in the CMS screenshots you posted:

1) TU and EQ have very different dates that they were last updated, neither of which is very recent. In the TU screenshots, it shows that the reporting for this tradeline is as of 07/06/2022; in the ones for EQ it's 10/04/2023. This could be some or all of the reason why the reporting on these two bureaus is different, depending on the status of the tradeline on each of these two dates. (It's not uncommon for a CO to stop updating, which can artificially boost your score as time passes by making the delinquency look older than it is.)

2) TU is reporting like a charge-off that was sold to a collection agency, with a balance of $0 and a status of unpaid charge-off.

3) From the other two bureaus, I'm not sure why the tradeline would have fallen off your EX report. The oldest delinquency in the EQ payment summary is 07/2022, which is already at full CO status. Even with some number of months of lead-up delinquency, that's still pretty far off from 7 years. It may just be a bank error in your favor. Do you have any older EX reports showing the status and payment history of this tradeline before it fell off?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Confused by my SL charge off- need help interpreting convo w/creditor, & next steps

Here are the best answers I can give to a few of your other questions:

@lowspender wrote:

-The debt stays at the university "forever," they never sell it to a creditor. Is forever possible? Maybe you can't take another class before paying off old debt.. but nothing stays on a report forever ? Can they update your DOLA for life, so it never falls off? Seems impossible.

They can update DOLA if and whenever there's activity on the tradeline (e.g. a partial payment), but that's different from the DoFD (date of first deliquency), which is the date the tradeline first went delinquent without being brought current again. That's the date that determines reporting timelines for CO and CA, and creditors can't move this date forward, which would be illegal re-aging.

If they never sell it and it stays forever, wouldn't it fall off by itself? I'm not willing to trade that time for the blemish to sit there, but.. don't understand. From my understanding, if it was "paid," fico 9 has minimal if any penalty against your score for that, all the more reason to have it paid.

Whether or not you pay the CO, it should fall off your reports at the end of its reporting timeline (7 years from DoFD). I don't know how FICO9 handles paid COs, but there are two things I can point out: 1) a paid CO will look better for manual underwriting and 2) paying a CO that hasn't been updating (like yours) can drop your score in the short term, b/c all the delinquent months between the most recent update and date of payment will now be reported.

-Said "your transunion record is there for your whole life, nothing is ever gone." Specifically pointed to TU. Well, that's not true..

I don't know what TU's retention policies for data that has aged off of reports are, but a CO on TU will have the same reporting timeframe as on the other two major bureaus (7 years).

-Credit bureaus are often behind in updating reports and it "often takes 8 months for that to show up on a report. Is 8 months "standard"? Delays happen, but.. standard?

8 months wouldn't be a standard delay for regular reporting. More like 1-2 months, if any. Whether 8 months would be standard for this particular creditor reporting a CO as paid, I can't say.

Takeaways? I assume negotiating isn't really an option. Their policy is against pay for delete- is a post payment goodwill letter an unlikely option? Know it can be frowned on by the bureaus to have it reported if it wasn't really an "error."

I think a post-payment goodwill letter is pretty unlikely to yield any results, both because this is a student loan and because the delinquency is severe. It can still be a good idea to send them, though, since the cost in time and resources to do so is low and the potential reward is high (if unlikely to be realized).

Are inaccurate collections agent statements grounds for any sort of "legit" error in disputing the debt (pre or post payment)?

I'm not completely clear on what you're asking in this last question, but grounds for disputing reported data will just be whether that data is accurate, which is independent of anything a collection agent might or might not say. (If the collection agent has made statements in the course of trying to collect your debt that break the law, then there are other things that you can do with that, ofc.)

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Confused by my SL charge off- need help interpreting convo w/creditor, & next steps

@Slabenstein wrote:1) TU and EQ have very different dates that they were last updated, neither of which is very recent. In the TU screenshots, it shows that the reporting for this tradeline is as of 07/06/2022; in the ones for EQ it's 10/04/2023. This could be some or all of the reason why the reporting on these two bureaus is different, depending on the status of the tradeline on each of these two dates. (It's not uncommon for a CO to stop updating, which can artificially boost your score as time passes by making the delinquency look older than it is.)

Thanks for all this detail in your response. Can the CO ever resume updating, and is that likely? Is the point difference more likely due to the additional year of aging on the TU report, or the balance showing 0% paid on EQ, and 100% paid off (as if debt was sold) on TU? Also, notice EQ does not show the status as a charge-off, in the pics in my previous post. TU does though. Another mistake? That is the newest report from each bureau.

2) TU is reporting like a charge-off that was sold to a collection agency, with a balance of $0 and a status of unpaid charge-off.

If I sign up with them, can I look at older reports they issued? I rarely do 3 bureau pulls on Experian, so I have no other TU reports to look at that are recent enough to help. So the balance of $0 and the status of it being unpaid make it seem as if it was sold off- does the 100% paid off at the top, just below "balance details," also point to that? No "company sold" details exist on any report, for any bureau, any month.. and to me that is the most unlikely option. They said repeatedly it would never be sold.. why spend time talking to me and suggesting ways to pay, if it was sold off.. ? Who is TU suggesting it is sold to, with no purchasing company listed? Even seeing an older report still wouldn't explain why the current one looks this way.

3) From the other two bureaus, I'm not sure why the tradeline would have fallen off your EX report. The oldest delinquency in the EQ payment summary is 07/2022, which is already at full CO status. Even with some number of months of lead-up delinquency, that's still pretty far off from 7 years. It may just be a bank error in your favor. Do you have any older EX reports showing the status and payment history of this tradeline before it fell off?

Yeah, this one is just pure "monopoly bank error in your favor" territory- side by side are how this looked in December, before the charge off (in early Jan), and the change in Feb, before now disappearing in March. Can it return? Assuming that is not grounds for a dispute? Impossible for it to have aged off.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Confused by my SL charge off- need help interpreting convo w/creditor, & next steps

@Slabenstein wrote:They can update DOLA if and whenever there's activity on the tradeline (e.g. a partial payment), but that's different from the DoFD (date of first deliquency), which is the date the tradeline first went delinquent without being brought current again. That's the date that determines reporting timelines for CO and CA, and creditors can't move this date forward, which would be illegal re-aging.

I've heard of re-aging happening, debt buyers not checking dates, or it be done with shady intent etc- can it be legally done in my favor? I'm guessing at the charge off stage, it's too late for this to happen? Making it current again, basically. What about reaging the debt to be at the point of falling off the report?

Whether or not you pay the CO, it should fall off your reports at the end of its reporting timeline (7 years from DoFD). I don't know how FICO9 handles paid COs, but there are two things I can point out: 1) a paid CO will look better for manual underwriting and 2) paying a CO that hasn't been updating (like yours) can drop your score in the short term, b/c all the delinquent months between the most recent update and date of payment will now be reported.

To how fico 9 handles paid COs, I think this is the answer. So to point 1, if a request goes past automated approvals, the paid CO looks better for manual- got it. All the delinquent gap months being reported is definitely a concern. Thinking the trade off from point 1 approvals may help, but.. still an effect on score. Not sure how much, referenced that above with the slight differences between EQ and TU- TU looking sold may be playing the bigger role there.

8 months wouldn't be a standard delay for regular reporting. More like 1-2 months, if any. Whether 8 months would be standard for this particular creditor reporting a CO as paid, I can't say.

This was them simply blaming the bureaus for being slow. Said they couldn't control when it was reported (not true, once they submit the report, right?) and that they often heard it was taking that long to report.

It came up bc I thought I'd resolve this in part, by basically maxing out my card and paying it, expecting them to update the bureaus, boost my score, and I would qualify for a better card (get a year of 0% interest) do a balance transfer, etc. That would have to happen within 2 statements. So when they said they can't control when the bureaus report things, it became a much higher risk option.

I think a post-payment goodwill letter is pretty unlikely to yield any results, both because this is a student loan and because the delinquency is severe. It can still be a good idea to send them, though, since the cost in time and resources to do so is low and the potential reward is high (if unlikely to be realized).

Delinquency is severe in terms of time, or amount? Does the payment record before the delinquency record have nothing to do with odds of it being granted? I assume statements made by collections agents, or anyone involved in collection attempts, don't play any role there?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Confused by my SL charge off- need help interpreting convo w/creditor, & next steps

Answers, as best I can give them, in blue:

@lowspender wrote:

@Slabenstein wrote:1) TU and EQ have very different dates that they were last updated, neither of which is very recent. In the TU screenshots, it shows that the reporting for this tradeline is as of 07/06/2022; in the ones for EQ it's 10/04/2023. This could be some or all of the reason why the reporting on these two bureaus is different, depending on the status of the tradeline on each of these two dates. (It's not uncommon for a CO to stop updating, which can artificially boost your score as time passes by making the delinquency look older than it is.)

Thanks for all this detail in your response. Can the CO ever resume updating, and is that likely? It could resume updating at any time, if the creditor sends an update to the bureaus. That's most likely to happen when there's something to prompt them to do so, like a payment or a dispute. Is the point difference more likely due to the additional year of aging on the TU report, or the balance showing 0% paid on EQ, and 100% paid off (as if debt was sold) on TU? Score differences between two bureaus will be due to all differences in scorable data between the two, as well as minor differences in how the algos are customized for each bureau. Without both of your full reports, it would be hard to say what the most likely cause of the score difference is. I don't know how charged-off installments are factored into scoring for installment current-balance-to-original-loan-amount ratio, so I'm not sure what the impact of $0 balance vs. over 100% on one would be. 15 additional months of aging on a charge-off is a decent chunk of time, but charge-offs also hold your score down significantly the whole 7 years, so I don't know how much of the score difference would be due to this, either. Also, notice EQ does not show the status as a charge-off, in the pics in my previous post. TU does though. Another mistake? That is the newest report from each bureau. From the screenshots below, I'd guess that EQ is reporting a payment status of collection account from 7/2022 through 9/2023. The CMS you took the screenshots from should have a key somewhere that tells you exactly what the payment status symbols mean. Really, to verify exactly how this tradeline is reporting on each bureau, you'll want to pull your ACR's, since that's as close to the source as a consumer can get.

2) TU is reporting like a charge-off that was sold to a collection agency, with a balance of $0 and a status of unpaid charge-off.

If I sign up with them, can I look at older reports they issued? TU's website only lets you pull a fresh report. Other CMS will show reports you've previously pulled, but no CMS lets you pull a new, backdated report. To my knowledge, that's not something the bureaus could even offer. I rarely do 3 bureau pulls on Experian, so I have no other TU reports to look at that are recent enough to help. So the balance of $0 and the status of it being unpaid make it seem as if it was sold off- does the 100% paid off at the top, just below "balance details," also point to that? No "company sold" details exist on any report, for any bureau, any month.. and to me that is the most unlikely option. They said repeatedly it would never be sold.. why spend time talking to me and suggesting ways to pay, if it was sold off.. ? Who is TU suggesting it is sold to, with no purchasing company listed? Even seeing an older report still wouldn't explain why the current one looks this way. TU isn't suggesting it was sold to anyone. It's just that a delinquent tradeline can only report its balance once, so if a collection agency is reporting a debt that was charged off, the OC can't also report the balance on the CO tradeline. So if you see an unpaid CO with a $0 balance, usually the only way that should have happened would be if there was also a CA reporting the debt. Most often that happens if the OC has sold the debt to a CA, but I could also happen if the OC has only hired a collection agency to collect but retains the debt, and the CA reports. It's possible this latter scenario is why the tradeline is showing on TU the way it is. A reporting error is ofc another possibility.

3) From the other two bureaus, I'm not sure why the tradeline would have fallen off your EX report. The oldest delinquency in the EQ payment summary is 07/2022, which is already at full CO status. Even with some number of months of lead-up delinquency, that's still pretty far off from 7 years. It may just be a bank error in your favor. Do you have any older EX reports showing the status and payment history of this tradeline before it fell off?

Yeah, this one is just pure "monopoly bank error in your favor" territory- side by side are how this looked in December, before the charge off (in early Jan), and the change in Feb, before now disappearing in March. Can it return? It's possible it could return, as long as the new reporting is accurate. These screenshots for Experian are intersting, since they have the most recent reporting on this tradeline. It looks like the tradeline was reporting with a payment status of collections and a past-due balance owed up through 11/2023. Then it was reported as CO status with a $0 balance for 12/2023, and then it fell off your report in March. If I'm correctly understanding that you took the loan out directly from the school, this progression could indicate that they've passed the debt on to the guarantor. Assuming that is not grounds for a dispute? Impossible for it to have aged off. Again, I'm not entirely sure what you're asking, regarding grounds for a dispute, but grounds for any dispute is just the reported information being inacurate. That's it. Generally, the most a dispute will accomplish is any inaccurate information (including bank errors in your favor) being made accurate.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Confused by my SL charge off- need help interpreting convo w/creditor, & next steps

@lowspender wrote:

@Slabenstein wrote:They can update DOLA if and whenever there's activity on the tradeline (e.g. a partial payment), but that's different from the DoFD (date of first deliquency), which is the date the tradeline first went delinquent without being brought current again. That's the date that determines reporting timelines for CO and CA, and creditors can't move this date forward, which would be illegal re-aging.

I've heard of re-aging happening, debt buyers not checking dates, or it be done with shady intent etc- can it be legally done in my favor? To my knowledge, the only time reaging is allowed is when the reported DoFD is inaccurate (in which case it isn't really re-aging). I'm guessing at the charge off stage, it's too late for this to happen? The scenario described there wouldn't happen for a student loan. (It looks like they're talking about a creditor reporting an account current because the borrower has started a negotiated repayment plan. I personally wouldn't call that re-aging, since it's just a DoFD reset due to the account being considered as brought current, the same as would happen if the debt was brough current according to the original terms of the note.) Making it current again, basically. What about reaging the debt to be at the point of falling off the report? If you're asking whether a creditor would move a DoFD more recent than 7 years so it was 7 years in the past, no, they wouldn't.

Whether or not you pay the CO, it should fall off your reports at the end of its reporting timeline (7 years from DoFD). I don't know how FICO9 handles paid COs, but there are two things I can point out: 1) a paid CO will look better for manual underwriting and 2) paying a CO that hasn't been updating (like yours) can drop your score in the short term, b/c all the delinquent months between the most recent update and date of payment will now be reported.

To how fico 9 handles paid COs, I think this is the answer. That's talking about how FICO9 & 10 score paid CA's, not CO's. 9 & 10 aren't very widely used, in any case. So to point 1, if a request goes past automated approvals, the paid CO looks better for manual- got it. I just meant that even though a paid CO can still have a significant negative score impact, paid is generally going to be much, much better than unpaid to a loan officer reviewing a credit app. All the delinquent gap months being reported is definitely a concern. Thinking the trade off from point 1 approvals may help, but.. still an effect on score. Not sure how much, referenced that above with the slight differences between EQ and TU- TU looking sold may be playing the bigger role there. If you're debating paying vs. not paying due to score effect, imo the near-term score loss is going to be outweighed by the benefits of payoff. If you pay it off, it can start to age in truth and won't be a flashing red flag for however much of 7 years its weird reporting has left. Garnishment is also pretty much a given with delinquent student loans (and I would personally rather wait out some delinquency aging than deal with that). Another thing to consider is that the parts of the weird reporting that are currently in your favor won't necessarily stay that way. From my experience with delinquent student loans, they can pop on and off of your report and go long periods without updating before updating again, as well as doing these things inconsistently across the bureaus. (I think this happens because who is servicing the debt and who is holding it can both change over time.)

8 months wouldn't be a standard delay for regular reporting. More like 1-2 months, if any. Whether 8 months would be standard for this particular creditor reporting a CO as paid, I can't say.

This was them simply blaming the bureaus for being slow. Said they couldn't control when it was reported (not true, once they submit the report, right?) and that they often heard it was taking that long to report. It's true that they can't control what the bureaus will do once they submit their data, the bureau's part of the process should be pretty quick. Like, afaik, on the order of days quick. (One thing that comes to mind as to why they could see a longer delay is that, like most smaller creditors, they're probably using an intermediary to format their data into Metro 2 and submit that to the bureaus on their behalf. I guess it could be the case that their intermediary just really sucks.) It came up bc I thought I'd resolve this in part, by basically maxing out my card and paying it, expecting them to update the bureaus, boost my score, and I would qualify for a better card (get a year of 0% interest) do a balance transfer, etc. That would have to happen within 2 statements. So when they said they can't control when the bureaus report things, it became a much higher risk option. Sounds risky to me in any case; I wouldn't count on a large score increase from paying it off, esp if the debt reappears as a revolving utilization hit.

I think a post-payment goodwill letter is pretty unlikely to yield any results, both because this is a student loan and because the delinquency is severe. It can still be a good idea to send them, though, since the cost in time and resources to do so is low and the potential reward is high (if unlikely to be realized).

Delinquency is severe in terms of time, or amount? Both. Highest severity of delinquent payment status, long string of delinquent payments. Does the payment record before the delinquency record have nothing to do with odds of it being granted? When you're asking for a goodwill deletion, you're ultimately asking for a particular person to grant it (i.e. whoever your letter ends up with). So, really, it will just be what that particular person thinks about it--but with the length of the delinquency in this case I wouldn't expect it to matter at all. I assume statements made by collections agents, or anyone involved in collection attempts, don't play any role there? I don't see how they would.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Confused by my SL charge off- need help interpreting convo w/creditor, & next steps

@Slabenstein wrote:

If you're debating paying vs. not paying due to score effect, imo the near-term score loss is going to be outweighed by the benefits of payoff. If you pay it off, it can start to age in truth and won't be a flashing red flag for however much of 7 years its weird reporting has left. Garnishment is also pretty much a given with delinquent student loans (and I would personally rather wait out some delinquency aging than deal with that). Another thing to consider is that the parts of the weird reporting that are currently in your favor won't necessarily stay that way. From my experience with delinquent student loans, they can pop on and off of your report and go long periods without updating before updating again, as well as doing these things inconsistently across the bureaus. (I think this happens because who is servicing the debt and who is holding it can both change over time.)

To the first part, not debating paying vs not paying, more the timing of payment to avoid tanking my score (by paying) and giving myself the best chance at some good cards as I pay it down and let the DoFD and DoLA get further away. Won't the weird reporting also most likely chance to current & accurate, when the dent is reported as paid? Why all the bureaus stopped updating, I don't know.. but since they will update the bureaus when it's paid, that will have to at least update the DoLA, right?

I don't want to deal with it coming and going for 7 years, although some of those consequences (e.g. garnishment) are pretty unlikely since the loan isn't federal. Again technically, it's not even private. There aren't terms or interest, it's simply a LONG overdue invoice. To your last line, that partly depends on whether this agent (head of the office) was accurate in their statement that "we never sell the debt," which would make who services/holds it a constant.

@Slabenstein wrote:

It's true that they can't control what the bureaus will do once they submit their data, the bureau's part of the process should be pretty quick. Like, afaik, on the order of days quick. (One thing that comes to mind as to why they could see a longer delay is that, like most smaller creditors, they're probably using an intermediary to format their data into Metro 2 and submit that to the bureaus on their behalf. I guess it could be the case that their intermediary just really sucks.) It came up bc I thought I'd resolve this in part, by basically maxing out my card and paying it, expecting them to update the bureaus, boost my score, and I would qualify for a better card (get a year of 0% interest) do a balance transfer, etc. That would have to happen within 2 statements. So when they said they can't control when the bureaus report things, it became a much higher risk option. Sounds risky to me in any case; I wouldn't count on a large score increase from paying it off, esp if the debt reappears as a revolving utilization hit.

To the first part, I do wonder if they're classified as a small creditor- very large public university, I have to imagine they're not too small.. but perhaps the intermediary, as you mentioned, is.. bad. Honestly it came off more like some of the other statements they made outside of institutional policy (which I hope they were more accurate about, in their claims)- half accuracies with some confusion woven in.

Great point on the lack of score boost re: revolving credit- the low score reports all show it as an installment loan. Does that have a more dramatic affect on score change? I guess most of all is the overall effect on my dti ratio.

Somewhat separate from all of this- to at least carry part of my payoff plan out- apping for favorable cards that will likely have my best reports pulled would be good timing, yes? Finding out who mainly uses Ex ![]() Chase is likely to offer me a sp increase on my current card, but the 0% period is long gone. They're preapproved me for 2x and 3.5x my current chase limits with the CS/CSR card- I don't recall if cli's from them tend to come at the expense of the ceiling on new cards from them, or not. They're a soft pull cli, but I'd rather not limit the cap of something else from them. I'd like to get a cli on my other card first to possibly encourage a higher limit (ymmv), but that increase won't show until the next report is out, which.. may be different

Chase is likely to offer me a sp increase on my current card, but the 0% period is long gone. They're preapproved me for 2x and 3.5x my current chase limits with the CS/CSR card- I don't recall if cli's from them tend to come at the expense of the ceiling on new cards from them, or not. They're a soft pull cli, but I'd rather not limit the cap of something else from them. I'd like to get a cli on my other card first to possibly encourage a higher limit (ymmv), but that increase won't show until the next report is out, which.. may be different ![]()

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Confused by my SL charge off- need help interpreting convo w/creditor, & next steps

@lowspender wrote:

@Slabenstein wrote:

If you're debating paying vs. not paying due to score effect, imo the near-term score loss is going to be outweighed by the benefits of payoff. If you pay it off, it can start to age in truth and won't be a flashing red flag for however much of 7 years its weird reporting has left. Garnishment is also pretty much a given with delinquent student loans (and I would personally rather wait out some delinquency aging than deal with that). Another thing to consider is that the parts of the weird reporting that are currently in your favor won't necessarily stay that way. From my experience with delinquent student loans, they can pop on and off of your report and go long periods without updating before updating again, as well as doing these things inconsistently across the bureaus. (I think this happens because who is servicing the debt and who is holding it can both change over time.)To the first part, not debating paying vs not paying, more the timing of payment to avoid tanking my score (by paying) and giving myself the best chance at some good cards as I pay it down and let the DoFD and DoLA get further away. Won't the weird reporting also most likely chance to current & accurate, when the dent is reported as paid? In your shoes, I would operate under that assumption. They should send an update the the bureaus when you pay, and that should have an account status of paid & closed and should have historical payment status for all of the reportable months up through the month of payment. Why all the bureaus stopped updating, I don't know.. The short answer is that the creditor stopped reporting, either due to a glitch or deliberately. but since they will update the bureaus when it's paid, that will have to at least update the DoLA, right? DoLA will update whenever there's reported activity, which a payment would be. DoLA isn't a scored metric and it doesn't have any bearing on the reporting timeframe; I wouldn't worry about it.

I don't want to deal with it coming and going for 7 years, although some of those consequences (e.g. garnishment) are pretty unlikely since the loan isn't federal. Again technically, it's not even private. There aren't terms or interest, it's simply a LONG overdue invoice. Ah, okay, I had been operating under the assumption that this was student loan debt. From what you say here, it sounds like this is a collection tradeline for charges you incurred at the school that were never paid in any way, either with a student loan or out-of-pocket. Is that correct? To your last line, that partly depends on whether this agent (head of the office) was accurate in their statement that "we never sell the debt," which would make who services/holds it a constant. What I was saying about servicers and holders really only applies to student loans. (Servicer is who administrates your loan, e.g. Nelnet, MOHELA, etc; holder is who owns the debt, e.g. the federal government, the school's guarantor, a bank.) I can't speak to what this particular instituion might or might not do, but, since it sounds like you're dealing with an unpaid bill rather than a delinquent loan, I'd expect the debt would stay with them.

@Slabenstein wrote:

It's true that they can't control what the bureaus will do once they submit their data, the bureau's part of the process should be pretty quick. Like, afaik, on the order of days quick. (One thing that comes to mind as to why they could see a longer delay is that, like most smaller creditors, they're probably using an intermediary to format their data into Metro 2 and submit that to the bureaus on their behalf. I guess it could be the case that their intermediary just really sucks.) It came up bc I thought I'd resolve this in part, by basically maxing out my card and paying it, expecting them to update the bureaus, boost my score, and I would qualify for a better card (get a year of 0% interest) do a balance transfer, etc. That would have to happen within 2 statements. So when they said they can't control when the bureaus report things, it became a much higher risk option. Sounds risky to me in any case; I wouldn't count on a large score increase from paying it off, esp if the debt reappears as a revolving utilization hit.

To the first part, I do wonder if they're classified as a small creditor- very large public university, I have to imagine they're not too small.. but perhaps the intermediary, as you mentioned, is.. bad. I just meant that they don't have the scale for it to make sense to develop a way to do it in-house. (They don't, e.g., have the payment status of 150 million credit cards to report every month.) Honestly it came off more like some of the other statements they made outside of institutional policy (which I hope they were more accurate about, in their claims)- half accuracies with some confusion woven in.

Great point on the lack of score boost re: revolving credit- the low score reports all show it as an installment loan. Does that have a more dramatic affect on score change? I guess most of all is the overall effect on my dti ratio. Revolving utilization has a larger score impact than installment balance-to-starting-principal ratio, if that's what you're asking. DTI isn't scored (your income isn't part of your credit report), but it will be considered separately as a part of underwriting for any loan application.

Somewhat separate from all of this- to at least carry part of my payoff plan out- apping for favorable cards that will likely have my best reports pulled would be good timing, yes? Finding out who mainly uses Ex

When you have large differences among bureaus like this, looking for lenders that are more likely to pull your favorable bureau can be a good strategy. Just keep in mind that, anymore, a lot of lenders are going to look at more than one of your reports, whether via SP or HP, even if they favor EX. Chase is likely to offer me a sp increase on my current card, but the 0% period is long gone. They're preapproved me for 2x and 3.5x my current chase limits with the CS/CSR card- I don't recall if cli's from them tend to come at the expense of the ceiling on new cards from them, or not. They're a soft pull cli, but I'd rather not limit the cap of something else from them. Moving limits around with Chase is very easy. If you're approved for a new card but have hit the limits they feel comfortable offering you, they'll usually pull some limit from an existing card to open the new one. I'd like to get a cli on my other card first to possibly encourage a higher limit (ymmv), but that increase won't show until the next report is out, which.. may be different

In your shoes, I would focus on getting this collection from the school taken care of first, and then move forward from there. Kind of a personal priorities thing, which I know will be different for different people, but I tend to look at credit from sort of a "put down your foundation before you raise the walls" point of view.