- myFICO® Forums

- Types of Credit

- Mortgage Loans

- FICO mortgage scores

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

FICO mortgage scores

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

FICO mortgage scores

Hello, everyone, I need some help. My current FICO 8 scores are 610, 647, 653, however, my mortgage scores are 566, 571, 541. What am I doing wrong? what are the significant factors in the differences? I have all current payments on my 10 credit cards, a collection that is 6 years old (unpaid- waiting for it to drop off). I also have 3 small old charge offs that are about 4 years old. I understand that these things will hurt the report, but such a large difference in the scores? what can anyone recommend? thanks in advance.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FICO mortgage scores

@seeking850 wrote:Hello, everyone, I need some help. My current FICO 8 scores are 610, 647, 653, however, my mortgage scores are 566, 571, 541. What am I doing wrong? what are the significant factors in the differences? I have all current payments on my 10 credit cards, a collection that is 6 years old (unpaid- waiting for it to drop off). I also have 3 small old charge offs that are about 4 years old. I understand that these things will hurt the report, but such a large difference in the scores? what can anyone recommend? thanks in advance.

What does your revolving utilization look like ? It might help if you list your CCs / balances & limits.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FICO mortgage scores

Revolving util around 20% aggregate as well as on each card. also- as far as the 3 charge offs- they are still reporting as open accounts- how is this possible? if they charge off isnt that considered closed?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FICO mortgage scores

@seeking850 wrote:Revolving util around 20% aggregate as well as on each card. also- as far as the 3 charge offs- they are still reporting as open accounts- how is this possible? if they charge off isnt that considered closed?

No, until they are paid, they can, and usually do, report.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FICO mortgage scores

Revolving credit utilization is a big scoring factor in the mortgage scores, both aggregate and on individual cards.

Each charged off credit card that reports a balance is factored as a revolving account with 100% utilization, on top of it being a derogatory item, even just one is a score killer.

Current FICO8:

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FICO mortgage scores

This is what I was going to ask.

At the end of August I was at 591, 602, and 570 mortgage scores. I had 1 collection.

I paid down my debt by 50% of the balances and requested CLI's on all of my cards and paid off the collection of 4 years, and this past Sunday had my loan officer repull.

I'm now at 638, 634, and 613 in about 4 months.

I really think it's utilization and aging of accounts that worked in my favor.

Now I'm working to keep increasing the scores so that I can get better insurance rates :/

In My Wallet:

Total Credit Limit $18.1K | Utilization 16.37%

FICO 8s 7.2023

FICO 8s 2.2024

Starting Score: 633

Starting Score: 633Current Score: 654

Goal Score: 750

Take the myFICO Fitness Challenge

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FICO mortgage scores

@seeking850 wrote:Revolving util around 20% aggregate as well as on each card. also- as far as the 3 charge offs- they are still reporting as open accounts- how is this possible? if they charge off isnt that considered closed?

If the charge offs are reporting every month, they're suppressing your scores. The quickest way to address that is to pay/settle them. Once they update to show paid, zero balance, you should see an increase in your scores.

As a lender, I can run a score simulator to see how much it should improve you scores as well as other things that could help increase them.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FICO mortgage scores

@jjohnson wrote:

Now I'm working to keep increasing the scores so that I can get better insurance rates :/

For those of us that live in states where credit is a factor in insurance pricing, it is shocking how much cheaper insurance gets as credit scores increase.

Also, insurance credit scores also look at the average limit of your credit cards, with an average >$9000 putting you in the top bracket of the category. Credit inquiries and new accounts also ding you for the full 24 months.

My home insurance went down by >30% when I crossed over from the mid 600s to mid 700s. It was nearly 3x more expensive than it is now, for less coverage, when my scores were below 500 for a few months in 2016. Adjusting for inflation, it was even worse.

I should be getting even better rates when I reshop again later this month.

Current FICO8:

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FICO mortgage scores

@seeking850 wrote:Hello, everyone, I need some help. My current FICO 8 scores are 610, 647, 653, however, my mortgage scores are 566, 571, 541. What am I doing wrong? what are the significant factors in the differences? I have all current payments on my 10 credit cards, a collection that is 6 years old (unpaid- waiting for it to drop off). I also have 3 small old charge offs that are about 4 years old. I understand that these things will hurt the report, but such a large difference in the scores? what can anyone recommend? thanks in advance.

It appears that none have mentioned the elephant in the closet. What is it? It appears all your revolving accounts have balances. Fico mortgage algorithms severly penalize for "too many accounts with balances" - regardless of utilization. Fico 8 and Fico 9 put minimal weight on that metric by comparison.

So, if you have 10 cards, pay 5 down to $0 to help your Mortgage scores. The score penalty gets steeper for each card with a balance over 50% - particularly on EQ and TU. Not so much with EX. Remaining cards having balances should all report under 49% UT and more preferrably under 29%. Have a couple cards in the 29% to 49% range short term, if necessary, to achieve 50% or less with balances. Then focus on all cards under 29% and aggregate UT under 9%. Avoid utilization levels above 49% on cards and 29% in aggregate.

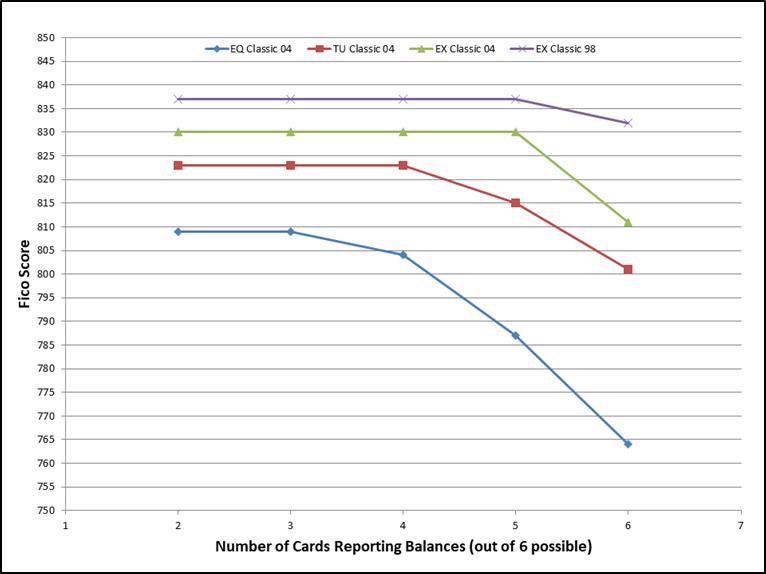

Again, # of accounts with balances is critical with mortgage Ficos - more so than low utilization particularly on dirty scorecards. The graph below is based on actual data [Fico mortgage scores: EQ Classic 04 = EQ score 5, TU Classic 04 = TU score 4, EX Classic 98 = EX score 2]. EX Classic 04 = EX score 3. With all data points below, aggregate utilization was held between 2% - 5%. Tested 6 of 6 with "small" balances 3 times to validate the big EQ drop. Scores dropped to 765, 765 and 764 from 809.

P.S. with 90+ day lates, collections and charge offs, the 5 year age point often coincides with a step change drop in negative impact.

Fico 8: .......EQ 850 TU 850 EX 850

Fico 4 .....:. EQ 809 TU 823 EX 830 EX Fico 98: 842

Fico 8 BC:. EQ 892 TU 900 EX 900

Fico 8 AU:. EQ 887 TU 897 EX 899

Fico 4 BC:. EQ 826 TU 858, EX Fico 98 BC: 870

Fico 4 AU:. EQ 831 TU 872, EX Fico 98 AU: 861

VS 3.0:...... EQ 835 TU 835 EX 835

CBIS: ........EQ LN Auto 940 EQ LN Home 870 TU Auto 902 TU Home 950

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FICO mortgage scores

@seeking850 wrote:Revolving util around 20% aggregate as well as on each card. also- as far as the 3 charge offs- they are still reporting as open accounts- how is this possible? if they charge off isnt that considered closed?

The main reason your scores are under 600 is due to the charge offs and possibly the collection (derogatory accounts/status). The low scores are indicative of the derogatory accounts reporting currently. The charge offs can be settled and your scores will go up once they report as paid/zero balance. The collection account is a different story. If it's reporting every month, the only way to stop the damage is to negotiate a pay for delete.