- myFICO® Forums

- FICO Scoring and Other Credit Topics

- Credit in the News

- WMT suing Capital One

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

WMT suing Capital One

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: WMT suing Capital One

@Brian_Earl_Spilner wrote:I'm not talking about 25k. Cap1 is just stingy, so any increase. I've gotten 1 in 3 years for a whopping 250. I'm sure that kind of tightness has not fallen on deaf ears at Walmart. People can't buy things like TVs when they're only approved for 300 and there's no growth.

I agree with this and I think Walmart should have actually stuck with Synchrony.

3/3/24

3/3/24

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: WMT suing Capital One

@Lou-natic wrote:

@Brian_Earl_Spilner wrote:I'm not talking about 25k. Cap1 is just stingy, so any increase. I've gotten 1 in 3 years for a whopping 250. I'm sure that kind of tightness has not fallen on deaf ears at Walmart. People can't buy things like TVs when they're only approved for 300 and there's no growth.

I agree with this and I think Walmart should have actually stuck with Synchrony.

Indeed. Many of the people I know that rely heavily on Walmart to stretch their budgets have cards and continuously carry a balance. None of them could get much use out of a 300 limit card. They literally need the card to be able to put food on the table at times or to buy school clothes or school supplies for their 4 or 5 kids. Forget simple luxuries like a new TV when theirs breaks down. At least with sync, if the UTI wasn't up there, they could still get increases when they all of a sudden need new tires. Cap1 just says too bad, so sad.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: WMT suing Capital One

Wasn't at one time Wal-Mart starting their own bank or get into the banking sector? Maybe they will start to service there own Visa or Mastcard? I don't know, just thinking out loud. I have a Cap One Wal-Mart card and I very much enjoyed that first year of 5% back but now that it's over it doesn't mean much to me anymore but I will be interested to see what's next.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: WMT suing Capital One

@CardHunter wrote:Wasn't at one time Wal-Mart starting their own bank or get into the banking sector? Maybe they will start to service there own Visa or Mastcard?

That's a good point, @CardHunter. While the lawsuit might be to negotiate better terms with Capital One, it could be an exit strategy and that strategy might not be towards another traditional bank. Walmart has been dabbling in the FinTech banking segment recently so they may be thinking of launching a FinTech-backed store card.

(Barron's: 03/01/21)

(PYMNTS: 01/26/22)

(PYMNTS: 09/14/22)

Not to mention that there have been a long string of efforts from Walmart to enter the banking sector over the past two decades. While this article from Motley Fool (09/24/14) mainly discusses Walmart entering a partnership with Green Dot Bank, it also mentions many of those earlier attempts.

"A recent partnership between Walmart and Green Dot Bank will soon bring banking to the under-served."

So, the next Walmart credit card could be a Fintech card issued by >ONE<

Business Cards

Length of Credit > 40 years; Total Credit Limits >$900K

Top Lender TCL - Chase 156.4 - BofA 99.7 - AMEX 95.0 - CITI 94.5 - NFCU 80.0 - SYCH - 65.0

AoOA > 30 years (Jun 1993); AoYA (Feb 2024)

* Hover cursor over cards to see name & CL, or press & hold on mobile app.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: WMT suing Capital One

@ChargedUp wrote:As far as payments posting, my Savor payments post to my balance and available credit as soon as I hit the "conform" button. Doesn't the same happen with their co-branded cards?

I actually agree with Walmart on the transactions posting and settling. For both my Capital One cards, it can take up to three times as long as Chase, Citi, or AMEX to go from pending to posted. On top of that my payments are also slower through Capital One. Not sure what on the backend makes this the case.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Walmart sues Capital One

Walmart wants out of its arrangement

Cap1 says Walmart is just trying to renegotiate their contract

I wonder if Cap1 will start easing up on credit like Chase did with Amazon

>5/2023 All 3 reports 840ish (F8) F9s = 850 but my app finger is still twitching

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Walmart sues Capital One

@Royalbacon I was thinking it and you said it. They squeeze everyone. I had an opportunity to supply them with our products years ago and walked away... They're insane and will eat you alive... no thanks.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: WMT suing Capital One

@Brian_Earl_Spilner wrote:

Many of the people I know that rely heavily on Walmart to stretch their budgets have cards and continuously carry a balance. None of them could get much use out of a 300 limit card. They literally need the card to be able to put food on the table at times or to buy school clothes or school supplies for their 4 or 5 kids. Forget simple luxuries like a new TV when theirs breaks down. At least with sync, if the UTI wasn't up there, they could still get increases when they all of a sudden need new tires. Cap1 just says too bad, so sad.

Would you want to be the lender to those people? I have a feeling this story is much deeper than reported. WM caters to low-income households with bad credit. I'm not trying to imply these are bad people, but they ARE risky for a bank. I'm willing to bet WM customers have a much higher default rate and CO was re-negotiating based on that and WM refused. Would you increase limits for those maxing their cards and making repeated late payments? Goodwill only goes so far.

I also have a hard time believing WM would back their own CC for the same reasons. Unless they can somehow push out a 35-40% APR with monthly fees.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: WMT suing Capital One

@AlanGJP wrote:Would you want to be the lender to those people? I have a feeling this story is much deeper than reported. WM caters to low-income households with bad credit. I'm not trying to imply these are bad people, but they ARE risky for a bank.

I'm willing to bet WM customers have a much higher default rate and CO was re-negotiating based on that and WM refused.

Would you increase limits for those maxing their cards and making repeated late payments? Goodwill only goes so far.

I also have a hard time believing WM would back their own CC for the same reasons. Unless they can somehow push out a 35-40% APR with monthly fees.

Wow. There's a lot to unpack here, @AlanGJP.

"WM caters to low-income households with bad credit."

Where to even start with this? Obviously, there are some inaccurate assumptions. (1) WM shoppers are low income. (2) Low Income households have bad credit. (3) Walmart wants customers with bad credit. Say what? ![]() All of these are false and demographics support the opposite.

All of these are false and demographics support the opposite.

(1) WM shoppers are low income.

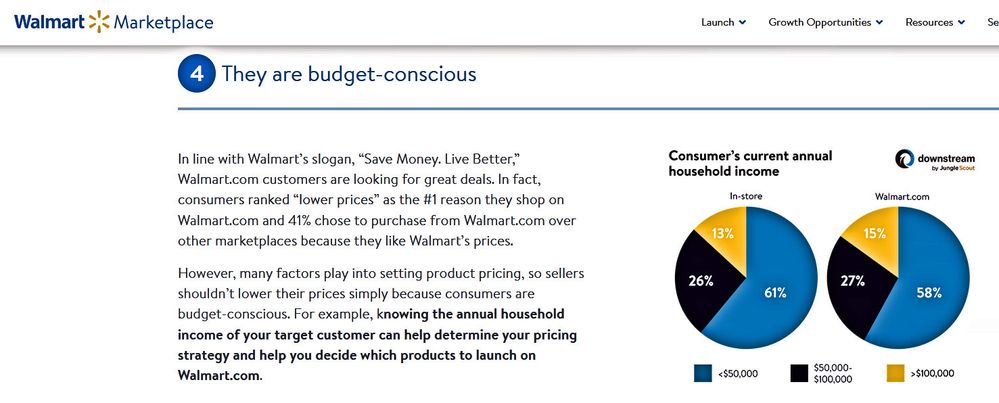

- Walmart's target demographic is not specific to income, race, sex, education, or credit score. While Walmart has a budget-conscious focus, that doesn't equate to low income. "The low prices and product variety at Walmart appeal to many different demographics, as they cater to the needs of the average consumer." (Source) Supporting data shows WM customers fairly evenly divided across the spectrum, including by income.

- According to 2022 data compiled by analytics firm Numerator and reported by Business Insider on 01/30/2023, Walmart's typical shopper in the US is a white woman between 55 and 64 years old, who is married and living in the suburbs of the Southeast. She typically has an undergraduate degree and earns about $80,000 per year. (The median US income last year was about $70K, so that customer earns more than median. census.gov)

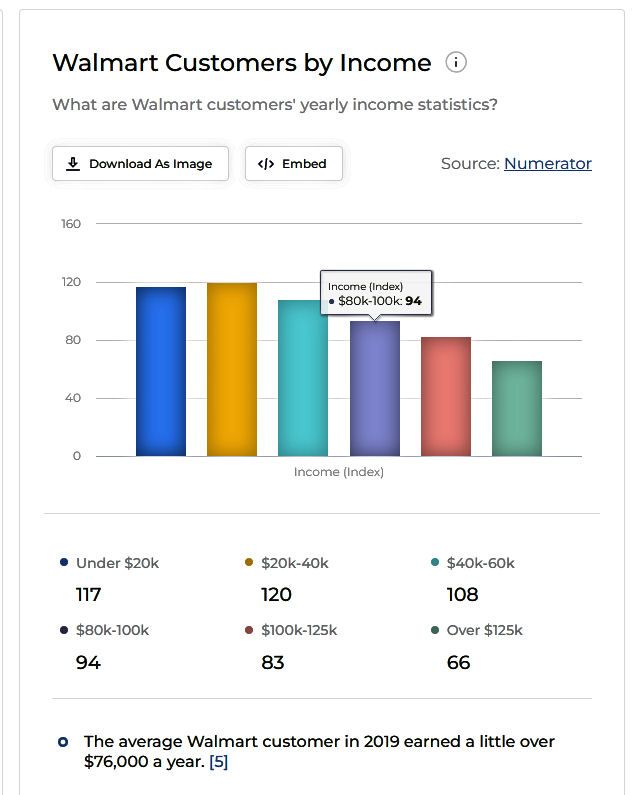

- This slide shows the income data of Walmart shoppers. Referencing the $70K median income, it's clear that even though the budget-conscious marketing may appeal slightly more to households below median than above median, there is a solid representation across a wide variety of incomes. (Source with other supporting slides.) Data is from 2019 so it shows a slightly lower income profile than above.

- Walmart's >own website< shows customer data from a wide range of incomes. The breakdown here is not as precise as the above and just uses $50K as a breakpoint, but still close to median income.

- This data is a little older (2012) when the median income was about $51K (census data) but still shows even representation of consumers across a wide range of incomes. (Source.)

-

(2) Low Income households have bad credit.

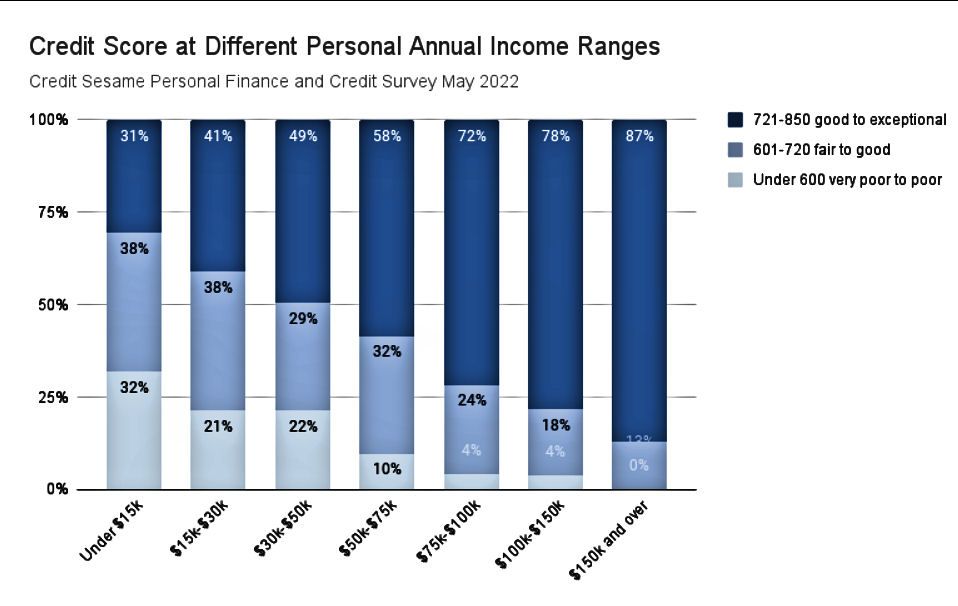

There is some weak correlation data between income and credit scores but correlation is not causation, per this Credit Sesame graphic and article on the subject. Again, to make this general assumption is an exaggeration of the facts, similar to the points above. There are low income households with high credit scores and high income households with low credit scores.

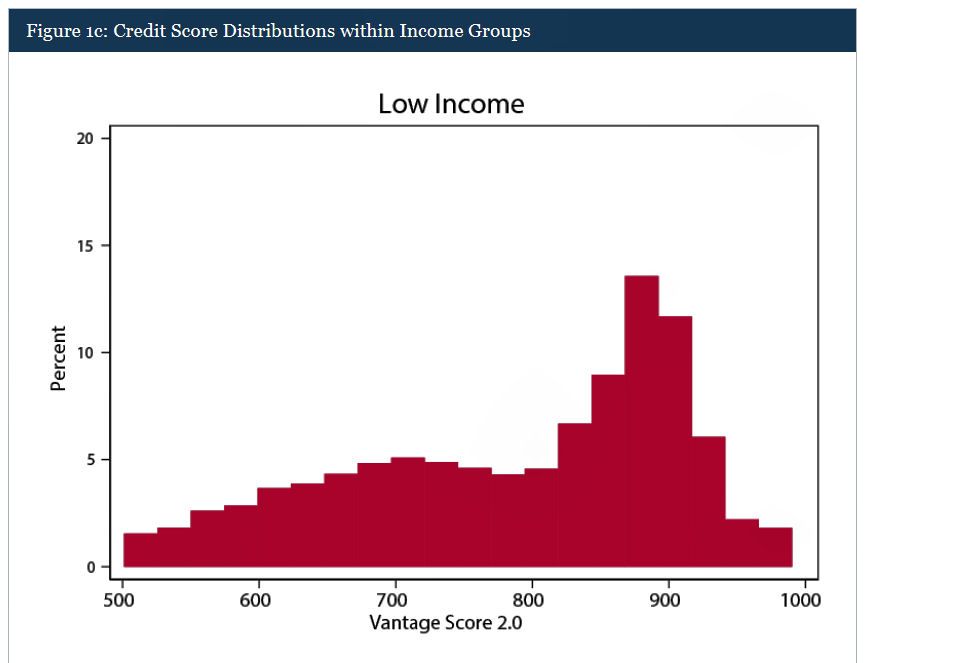

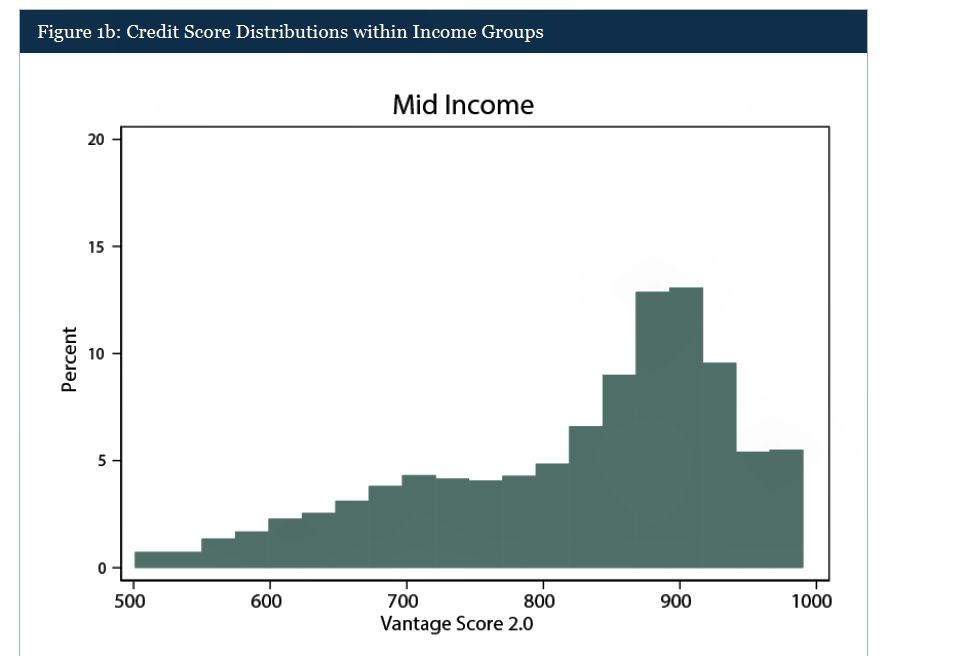

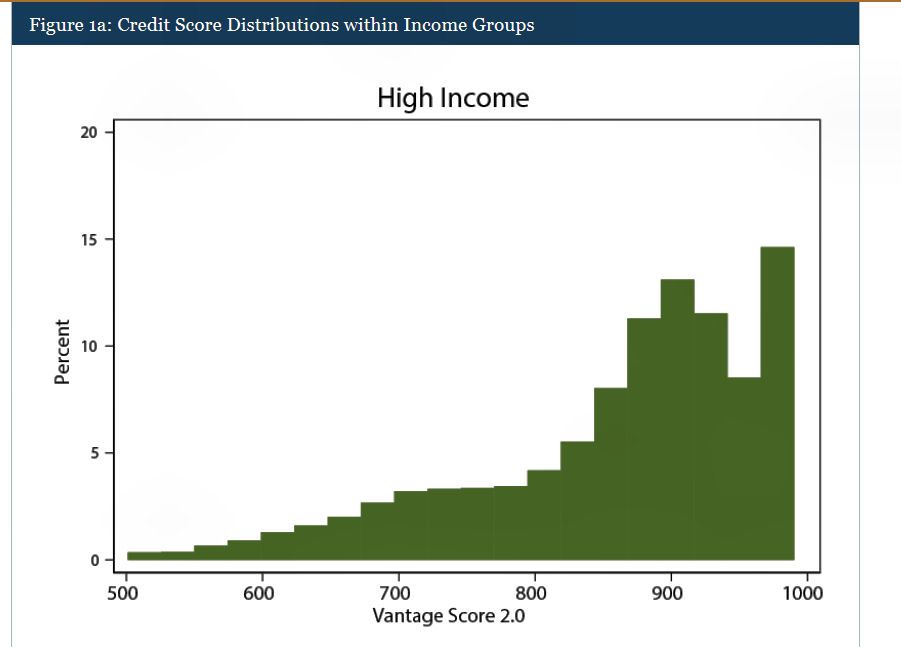

- Per this article published by the Federal Reserve, "we find a low correlation between credit score levels and income, with the correlation coefficient around 0.27 for income levels and 0.29 for log income." They did find a correlation as illustrated by histograms for various income groups and determined that "household income is moderately correlated with consumers' credit scores, and cross-sectional variations in household income account for a modest fraction of variations of credit scores." But in the end, they agreed with earlier studies that "income has only limited signaling power with respect to one's credit risks."

- As we know on My FICO, a low score isn't always an indication of irresponsibility or even distress. In some cases, a low score is simply from an undeveloped credit file. Those with lower incomes may have challenges qualifying for loans or credit cards based on a limited ability to repay, which would tend to keep scores suppressed. Implying that a low score always = irresponsible behavior does a disservice to those building their credit. Again, correlation is not causation. The Federal Reserve article above noted, "The additional explanatory power of income becomes minimal once a small set of credit history variables are accounted for."

(3) Walmart wants customers with bad credit.

Walmart targets (and successfully attracts) customers who are budget-conscious, regardless of their income or credit score.

"I'm willing to bet WM customers have a much higher default rate and CO was re-negotiating based on that and WM refused."

No. Capital One wasn't renegotiating. Per the original article, Walmart filed a lawsuit against Capital One for breach of contract. Default rate of WM customers was unrelated.

"Capital One failed to meet customer care standards in at least five “critical” categories, including delivering replacement cards to customers within five days and promptly posting transaction and payment information to cardholders’ accounts, according to the lawsuit."

"Would you increase limits for those maxing their cards and making repeated late payments? Goodwill only goes so far."

I think this is insulting for our members upthread as well as any other responsible consumers who have been declined for CLIs from Capital One - who may not be guilty of maxing out cards or paying late. While this may be the case, making a blanket accusation and without supporting data points is inappropriate. Community data points, on the other hand, do indicate Capital One is less generous with credit limits than some other lenders, and that is often regardless of profile.

"I also have a hard time believing WM would back their own CC for the same reasons."

To clarify, the upthread discussion wasn't about WM directly backing their own lending. We discussed their previous forays into the bankng segment but most recent links indicated a possible partnership through a FinTech or digital platform. The link to the "ONE" website above discloses that the affiliated bank is Coastal Community Bank. In this regard, a WM partnership is not much different that any other co-branded credit card or FinTech card.

Banking services provided by Coastal Community Bank, Member FDIC. Approved accounts are FDIC insured up to $250,000 per depositor. ONE is a financial technology company, not a bank. ONE card is issued by Coastal Community Bank pursuant to licensing by Mastercard® International.

Business Cards

Length of Credit > 40 years; Total Credit Limits >$900K

Top Lender TCL - Chase 156.4 - BofA 99.7 - AMEX 95.0 - CITI 94.5 - NFCU 80.0 - SYCH - 65.0

AoOA > 30 years (Jun 1993); AoYA (Feb 2024)

* Hover cursor over cards to see name & CL, or press & hold on mobile app.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: WMT suing Capital One

This is my last response to this thread, it was not my intention to steer this in this direction.

However... I will preface my response with this - You are correct in that I did not research their customer base and my response reflected my personal experience and not researched statistics. I've been to many Walmart's across the US and most that I've visited were run-down and the customers there reflected that, as did the management with empty shelves, dirty and broken/worn floors, open boxes on shelves, dirty bathrooms, etc) Of the ones that weren't that bad, they would still be considered poorly maintained/run by say Target's standards. (Their primary like-for-like brick-and-mortar competitor) Also, their return area appears focused on check cashing, money transfers and (again imo) methods of squeezing money out of people that have no other option. None of that matters to this thread however, and I shouldn't have gone there. This is personal experience, purely anecdotal, and my opinion may vary greatly from others AND especially their Walmart vs those I've visited - I'm sure in portions of the country my experience may have been very different. So I digress...

To the point - Walmart has a storied history with credit card companies. Here is why I would avoid trusting Walmart when it comes to these lawsuits and choosing Walmart over whoever their suing this week...

Just some examples, including the most recent one:

- It's Deja Vu All Over Again: Walmart Sues Capital One To End Co-Branded Card Deal (https://seekingalpha.com/article/4594695-walmart-sues-capital-one-co-branded-card-deal) (This article is a good read)

"This lawsuit by Walmart is laughable and a terrible use of time for the US District Court for the Southern District of New York to have to review. Maybe we are totally wrong on Capital One’s processing capabilities, but this tactic by Walmart seems very reminiscent of the one with former partner Synchrony.

Just like it did before, Walmart is looking to re-negotiate the economic terms of its existing card partnership and achieve more favorable revenue sharing economics going forward. Why is it OK to use our court system to renegotiate contractual terms?"

(* This is why I said they are trying to renegotiate *)

- After Refusing to Take Apple Pay, Walmart Launches Walmart Pay (https://slate.com/business/2015/12/walmart-s-new-mobile-payment-service-walmart-pay-rivals-apple-pay...)

(* Why offer customers options? Especially those that you could take a cut from.)

- Walmart Sues Capital One On Co-Brand Partnership (https://www.paymentsjournal.com/rumble-on-aisle-5-walmart-sues-capital-one-on-co-brand-partnership/)

"We heard a story like this one back in 2019, when Walmart sued Synchrony on their co-brand card. Remember when Walmart sued Synchrony on their credit card, claiming that Synchrony was refusing to underwrite weak credit card accounts?"

(* This is why I said their customers had poor credit - Walmart themselves claimed this to be the case.)

Finally and most interestingly...

This time, the claim is different. Says the WSJ: “Walmart alleged that Capital One didn’t provide the customer service it was obligated to offer, such as replacing lost cards promptly. It also alleged that Capital One didn’t promptly post some transactions and payments to cardholders’ accounts.”

And Capital One is not taking the suit lightly. “The spokesman said Walmart’s lawsuit “is an attempt to renegotiate the economic terms of the partnership it agreed to just a few years ago or end the deal early.” He said that Capital One “will vigorously protect our contractual rights in court.”

It makes you wonder how much risk Walmart wants to assume. Their U.S. attempt at banking was lackluster, but it is evident that Walmart wants to get into the lending business itself. In December 2022, CNBC reported that Walmart is backing a fintech to get into BNPL lending. Walmart is the “majority owner of ‘One,’ the new venture led by Goldman Sachs veterans.

It appears Walmart is suing to end their agreement and offer their own card.

I don't care enough about this to continue down this hole any further, truthfully I'm sorry I responded at all.